Media and Internet Concentration in Canada Report 1984 – 2015

Introduction

This is the second report in an annual series that reviews current developments and long-term trends in the telecoms, internet and media industries in Canada. Building on the first report in this series, it addresses another simple but profoundly important question:

have telecom, internet and media markets become more or less concentrated over time and how do we know one way or another?

Answering this question is difficult because good data is hard to come by and the issue is highly politicized. As Philip Savage notes, debates over media concentration in Canada “largely occur in a vacuum, lacking evidence to ground arguments or potential policy creation either way”. As a result, the public policy record groans under the weight of “expert reports” bought and paid for by vested interests.

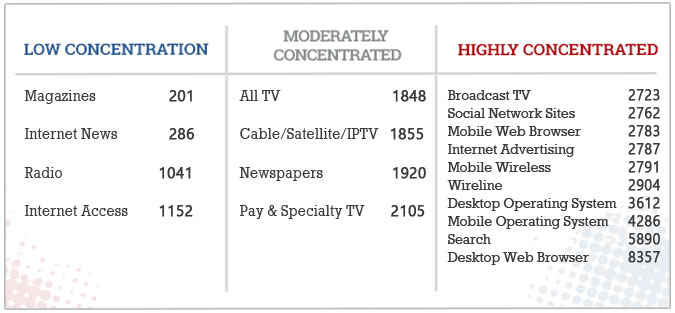

This report, which is conducted independently thanks to funding from SSHRC, analyzes concentration trends across the largest sectors of the telecoms, internet and media industries between 1984 and 2015: wireline and mobile wireless telecoms, internet access, television distribution (cable, satellite & IPTV), specialty and pay television, broadcast television, radio, newspapers, magazines, search engines, social media, internet news sources, internet advertising, desktop and mobile browsers and desktop and smart phone operating systems. These are the core elements of what I call the network media economy.

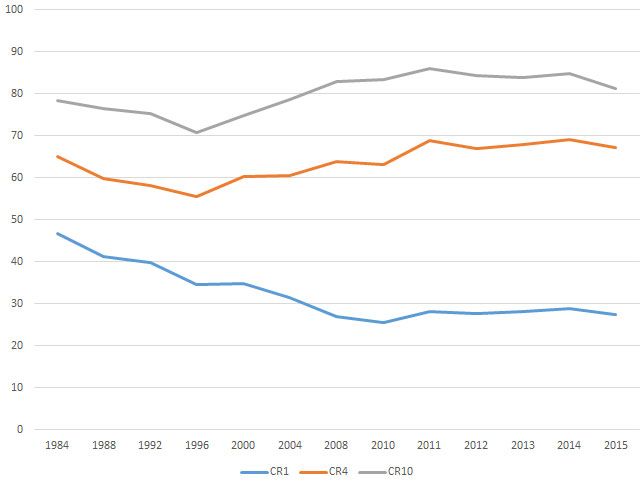

Concentration trends are assessed sector-by-sector, and then across the telecoms, internet and media landscape. Two common analytical tools — concentration ratios (CR) and the Herfindahl-Hirschman Index (HHI) – are used to judge whether markets are concentrated or competitive, and to chart the trends one way or another over time.

We have also made all of the data underlying this report available. It can be used for non-commercial and educational purposes on the basis of the Creative Commons license. A link to the workbook can be found here. A PDF of the full report can be downloaded here. Previous versions can be found for 2014, 2013, 2012 and 2011.

Contentious Debates, Main Issues: Four Schools of Thought

To some, studying media concentration in an age of the internet and information abundance is anachronistic.

As we showed in our last report, the total size of the network media economy has nearly quadrupled in size from $19.4 billion in 1984 to $78 billion last year. Fundamentally new segments have been added to the media economy during this period: mobile wireless, internet access, internet advertising as well as pay and over-the-top TV services, for example.

Currently, sixty hours of video are uploaded to Youtube every minute; there were about 4 million Netflix subscribers in Canada at the end of 2015; roughly 20 million Canadians had a Facebook account and many of them rely on the social networking site to get and share “the news”; expert blogs abound; pro-am journalists and whistle-blowers can set the news agenda; millions of websites are a click away; 684 TV services were licensed for service in Canada in 2015, 1085 radio stations and 99 paid daily newspapers;[1] the majority of Canadians have a smartphone; access to a world of information is easy; and Canadians are very extensive users of all kinds of different information and communications technologies. How can media and internet concentration possibly be a problem in this context?

The first school of thought sees only blue skies ahead for the network media economy. If there was ever a golden media age, this is it, argue Thierer & Eskelen, 2008. MIT media economics professor, Ben Compaine (2005) offers a terse one-word retort to anyone who thinks otherwise: Internet. Canadian media consultant Ken Goldstein agrees (see here and here). The problem is not media concentration but media fragmentation, he argues.

These views are shared by Canada’s largest telecom and media companies as a matter of course. As BCE said in 2013, critics allege that media concentration in Canada is high, but the evidence “regardless of the metric employed – proves otherwise” (Bell, para 46).

Furthermore, any attempt to shackle traditional media companies with ownership restrictions will likely put them at more of a disadvantage than they already are in the face of fast growing competition from global digital media behemoths such as Google, Amazon, Netflix, Facebook, and so on (Skorup & Thierer, 2012; Dornan, 2012). Again, Bell underscores the point in its 2015 Annual Report: “digital advertising revenues . . . [were] lower . . . due to [the] continued shift of advertising dollars to global players like Google and Facebook” (p. 68).

The lobbying agenda around these issues has certainly heated up in the last year as well as the new Trudeau Government found its place. The Liberal Government needs to do away with outdated regulation, a recent C.D. Howe report asserts, and stand aside and let the telecoms-internet and media giants compete amongst themselves for whatever temporary dominance they might gain, as C.D. Howe has argued before. Old laws need to be dismantled, a few new rules should be adopted to match the new technological conditions at hand, and matters would be best dealt with mainly through competition law and by having the CRTC’s sails trimmed, urges the report. Otherwise, the incumbents’ attempts to invest will be futile, the results of government intervention perverse, and short-term gains for consumers offset as the development of next generation broadband internet capabilities are put in jeopardy. Similar arguments are not hard to come by in the policy-think-tank-sphere, as recent reports from the Fraser Institute, the Montreal Economic Institute or the MacDonald Laurier Institute that echo these sentiments also attest.

This rhetoric of futility, perversity and jeopardy, however, also sounds a lot like the “rhetoric of reaction . . . in which conservative public figures, thinkers, and polemicists have been arguing against progressive agendas and reforms for the past two hundred years” (Hirschmann).

A second school of thought which includes prominent critics of media concentration such as Robert McChesney (2014) argue that, although there is no doubt that the digital revolution is radically changing the world, it is becoming clear that core elements of the internet are no less prone to concentration than traditional media. Ben Bagdikian also argues that when we look at the latter, the number of media firms in the US that account for the majority of revenues plunged from fifty in 1984 to just five in the early days of the 21st Century. Canadian critics decry what they see as similar trends, and the debasement of news and the political culture of the country that has ensued as a result (here and here).

Moreover, the internet, critics argue, is draining dollars away from newspaper advertising and exposing a fundamental reality of news: most people don’t want to pay for it. Consequently, the number of newspapers and full-time journalists in the US and parts of Europe are in free fall, while under-employed journalists are turning to public relations in droves (McChesney, 2014). Similar trends apply to Canada, but have lagged behind the US by a couple of years (see the last report on this point).

A third school aims to detect the influence of changes of media ownership and consolidation by quantitatively analyzing reams of media content. They generally find that the evidence is “mixed and inconclusive” (here and here).

Such findings, however, proceed as if ‘impact on content’ is the only concern, or as Todd Gitlin put it, as if ‘no effect’ might not be better interpreted as preserving the status quo and thus a significant problem in its own right. To my mind, reducing the range of questions at hand to a focus on content is akin to trying to draw a camel through the eye of a needle.

A fourth school of thought, and one that I largely subscribe to, agrees that the shift from the industrial media of the 19th and 20th centuries to the digital, internet-centric media ecology of the 21st century does entail enormous changes. However, it also argues that these changes entail an equally momentous “battle over the institutional ecology of the digital environment” (Benkler, 2006, ch. 11).

From this perspective, the history of human communication is one of recurring ‘monopolies of knowledge” (Innis, 1951) and oscillations between consolidation and competition (John, 2010; Babe, 1990). Why should our times be any different (Noam, 2009; Noam, 2016, Benkler, 2006; Wu, 2010; Crawford, 2012)?

This approach shares some similarities with the critical school in its insistence that core elements of the network media ecology and internet are no less prone to concentration than previous media. However, it breaks ranks on the grounds that while concentration is possible, it is not inevitable, and there are cross-cutting trends across media, over time and between countries. Moreover, outcomes turn on the specific configuration of technology, markets and politics that prevails in any given time and place. There is also more attention to empirical evidence as well as the details of specific media companies and markets in the thinking that informs this report, relative to most critical approaches and those who suggest that things are just fine.

From this perspective, the core elements of the networked digital media may actually be more prone to concentration because digitization magnifies economies of scale and network effects in many areas: mobile wireless (Rogers, BCE, Telus), search engines (Google, Bing, Yahoo, DuckDuckGo), Internet access (ISPs), music and book retailing (Apple and Amazon), social media (Facebook), browsers, operating systems, and access devices (Apple, Google, Nokia, Samsung). At the same time, however, digitization and the internet reduce barriers to entry in others areas, thereby allowing many small players to flourish. A two-tiered digital media system is emerging, with many small niche players revolving around a few enormous “integrator firms” at the centre (Noam, 2009; Wu, 2010).

Reflecting on the results of a thirty-country study, Noam (2013) finds that media concentration levels around the world are “astonishingly high” (p. 8). Three years after first making this preliminary observation, Noam (2016) continues to maintain that concentration levels for mobile wireless and other “platform media” are “astonishingly high” (see p. 25 and especially chapter 38, pp. 1307-1316). Insight into whether Canada ranks high, low or in between by international standards can be seen in Noam’s study, and the discussion that follows, especially around the issue of vertical integration.

Why Media Concentration Matters, or Who Cares?

These issues matter because the more core elements of the networked media are concentrated, the easier it is for dominant players to exercise market power, coordinate their behaviour, use tactics that aim to preserve their entrenched stakes in ‘legacy’ media sectors (e.g. television and film), lock up and leverage premium content to sell subscriptions to their more lucrative mobile phone, internet and cable services, stifle innovation, influence prices, work against market forces and subordinate the interests of consumers, citizens and the economy and society to their own interests (see here, here, here, here and here).

Large consolidated telecom, internet and media giants also make juicy targets for those who would turn them into proxies working on behalf of the copyright industries, cultural policy, efforts to block adult content, and as part of the machinery of law enforcement and national security (see here, here, here, here, here and here). The extent to which Google’s position at the centre of the internet has been leveraged by copyright interests and governments around the world to disable links to materials claimed to be infringing copyright, remove content, and to disclose information about its users is astounding, as its Transparency Report reveals. Indeed, such requests have soared in recent years.

In sum, the more concentrated digital media giants are, the greater their capacity to:

- turn market power into gate-keeping power and moral authority by regulating which content and apps gain access to their operating systems and online retail spaces and which cannot, as Apple’s decision to restrict adult content availability on iTunes and its removal of a fund-raising app for Wikileaks on the AppStore illustrate, for example;

- discourage the use of virtual private networks and anonymizing techniques to gird the geography and value of national media content rights markets while maximizing the identifiability and locatability of subscribers for advertising and other purposes (Ellis, 2016);

- be used to further cultural policy goals by, for example, applying a levy on telecoms and internet access providers to be used to support Cancon and other cultural policy goals, or to use deep packet inspection technologies to discover and give priority to Canadian content while discouraging access to other kinds of “less desirable” content (Geist, 2015; Taylor, 2015);

- set the terms for owning, controlling, syndicating and selling advertising around user created content (Google, Facebook, Twitter) (van Couvering, 2011; Fuchs, 2011);

- use the media outlets they own in one area to promote their interests in another, as former Vice President Media at Bell, Kevin Crull, did on several occasions before being ousted after caught meddling in CTV’s new coverage (see Telus intervention in Bell Astral, 2.0 pages 4-6 and here, here, here and here);

- set the terms for the distribution of income to musicians, journalists and media workers, and authors (Google, Apple, Amazon);

- set de facto corporate policy norms governing the collection, retention and disclosure of personal information to commercial and government third parties.

Whilst we must adjust our analysis to new realities, long-standing concerns also remain alive. Consider, for example, the fact that in the 2011 Canadian federal election every newspaper, except the Toronto Star, that editorially endorsed a candidate for Prime Minister touted Harper. In other words, 95% of editorial opinion expressed plunked for Steven Harper – roughly three times his standing in opinion polls at the time and the results of the prior election.

In the 2015 election, similar patterns emerged. Of the ninety-nine paid daily newspapers in Canada, twenty-three marshaled the energy to publish an editorial at all. Of those, seventeen newspapers representing 71% of the editorial opinion expressed lined up behind the ruling Conservatives.

The owners of the Postmedia Group, for example, directed the ten dailies that comprise its national chain of papers, and the six major Sun dailies in London, Toronto, Ottawa, Winnipeg, Calgary and Edmonton that it acquired earlier in 2015, to publish an editorial endorsement of Steven Harper for Prime Minister against the opposition of some of the chain’s journalists and editors (55% of expressed editorial opinion). The Globe and Mail took the peculiar stance of endorsing the Conservatives but not Harper (15.6% of expressed editorial opinion).

The wall of support was not as complete on this occasion, however. Torstar’s Toronto Star, Hamilton Spectator and Guelph Mercury (21% of expressed editorial opinion), for example, endorsed the Liberals, as did La Presse (Power Corp) (8% of expressed editorial opinion) and the Charlottetown Guardian (Transcontinental) (1% of expressed editorial opinion). No major daily endorsed the NDP, while Le Devoir cast its lot with the Bloc Québécois (representing 2% of expressed editorial opinion) (for a fuller treatment of this issue, see here).

As this discussion suggests, ultimately, talk about media concentration is a proxy for larger conversations about the shape of the mediated technological environments through which we communicate, consumer choice, freedom of the press, citizens’ communication rights and democracy. Of course, such discussions must adapt to new realities, but the advent of digital media does not render them irrelevant. In fact, it may make them more relevant than ever (Baker, 2007; Noam, 2009; Peters, 1999).

Methodology: How Do We Know Whether Media Concentration is Getting Better or Worse?

Measuring media concentration begins by setting out the media industries to be studied, as done at the outset of this post. Revenue data for each of these sectors, and for each of the firms within them with over a one percent market share, is then collected and analyzed. This handy dandy list of sources and others listed here were used.

Each media sector is analyzed on its own and then grouped into three categories, before scaffolding upwards to get a birds-eye view of the entire network media ecology: (1) platform media; (2) content media: (3) online media. Results are analyzed from 1984 to 2015, with an eye to capturing changes over time. Lastly, two common tools — Concentration Ratios (CR) and the Herfindhahl – Hirschman Index (HHI) – are used to depict concentration levels and trends within each sector and across the network media ecology as a whole.

The CR method adds the shares of each firm in a market and makes judgments based on widely accepted standards, with four firms (CR4) having more than 50 percent market share and 8 firms (CR8) more than 75 percent considered to be indicators of media concentration (see Albarran, p. 48). The Competition Bureau uses a more relaxed standard, with a CR4 of 65% or more possibly leading to a deal being reviewed to see if it “would likely . . . lessen competition substantially” (p. 19, fn 31).

The HHI method squares the market share of each firm in a given market and then totals them up to arrive at a measure of concentration. If there are 100 firms, each with 1% market share, then markets are thought to be highly competitive (shown by an HHI score of 100), whereas a monopoly prevails when one firm has 100% market share (with an HHI score of 10,000). The US Department of Justice embraced a revised set of HHI guidelines in 2010 for determining when concentration is likely to exist. The new thresholds are:

HHI < 1500 Unconcentrated HHI > 1500 but < 2,500 Moderately Concentrated HHI > 2,500 Highly Concentrated

At first blush, these higher thresholds seem to dilute the earlier standards that had been set back in 1992. While this may be true, the new guidelines can also be seen as being even more sensitive to reality and tougher than the ones they supersede.

This is because they give more emphasis to the degree of change in market power when ownership changes take place. For instance, “mergers resulting in highly concentrated markets that involve an increase in the HHI of more than 200 points will be presumed to be likely to enhance market power”, observes the DOJ (emphasis added, p. 19).

Second, markets are defined more precisely based on geography and the details of the good or service at hand versus loose amalgamations of things based on superficial similarities. This is critical. It distinguishes those who would define the media universe so broadly as to put photocopiers and chip makers alongside ISPs, newspapers, film and TV and call the whole thing “the media” (e.g. Skorup & Theirer; Compaine). In contrast, the scaffolding approach we use analyzes each sector before moving to higher levels of generality until reaching a birds-eye perspective on the network media as a whole.

Third, the new guidelines turn a circumspect eye on claims that enhanced market power will be good for consumers and citizens because they will benefit from the increased efficiencies that result. What is good for companies is not necessarily good for the country (see Stucke & Grunes, 2012; Mazzucato, 2014).

Lastly, the new guidelines are emphatic that decisions turn on “what will likely happen . . . and that certainty about anticompetitive effect is seldom possible and not required for a merger to be illegal” (p. 1). In practice this means the goal is to nip potential problems in the bud before they happen. It also means that experience, the best available evidence, contemporary and historical analogies as well as reasonable economic theories form the basis of judgment, not deference to impossible (and implacable) demands for infallible proof (p. 1).

These assumptions overturn three decades of Chicago School economic orthodoxy and its grip on thinking about market concentration (see Stucke & Grunes, 2012; Stucke & Grunes, 2016; Posner, 2011). Freed from such orthodoxy, and the subordination of policy and politics to conservative economists, think tanks and judges, the new guidelines set a tough hurdle for those with the urge to merge. It was such thinking that killed the bid by AT&T – the second largest mobile wireless company in the US – to acquire T-Mobile, the fourth largest, in 2011, for instance (also Stucke & Grunes, 2012). Similar concerns also loom at present as AT&T prepares a takeover bid for Time Warner.

This toughening up of the stance on concentration issues had largely passed Canadian regulators by but that has been changing in the past few years. The CRTC’s 2008 Diversity of Voices policy, for instance, created thresholds for a broadly defined TV market whereby a proposed deal that results in a single owner having less than 35% of the total TV market will be given the green light; those that fall in the 35-45% range might be reviewed; and anything over 45% will be rejected (para 87).

The CRTC’s threshold is based on a single snapshot of a single company’s share of one broadly defined market – the total TV market –“before” and “after” a single transaction. It is a static measure that has no sense of trends over time or capacity to analyze the drift of events across media and the network media ecology as a whole. Not surprisingly, the Diversity of Voices policy has done nothing to stop the tide toward consolidation within the broadcasting industries let alone between them and the telecommunications industries, as the evidence below demonstrates.

In contrast to the CRTC, the Competition Bureau at least does draw selectively from the US HHI guidelines. While it does not use the HHI thresholds, it does focus on “the relative change in concentration before and after a merger” (emphasis added, p. 19, fn 31).

The CRTC began to tiptoe in a different direction in 2012 and has continued to do so ever since. A number of major decisions in the past several years, however, suggest that the Commission has rediscovered market power, and the will to do something about it:

- the Mobile TV decision in which it shored up common carriage (network neutrality) principles by preventing mobile wireless carriers from unjustly discriminating against television programs and other types of communications delivered over the internet in favour of their own services. In doing so it effectively banned the nascent practice of zero-rating whereby some content service chosen by the carriers do not count towards your data caps, while similar types of services do. The decision is crucial because it reaffirms the principle that telecoms service and internet access providers are carriers not editors, a distinction that was upheld when the Federal Court of Appeal rejected an appeal of the Mobile TV decision by Bell;

- the Talk TV decision requiring the adoption of skinny basic cable TV packages and the unbundling of TV channels so that they are offered fully on an ala carte base by 2016;

- the mandated wholesale wireless framework designed to enhance competition in mobile wireless services by regulating wholesale roaming rates and other factors which affect the viability of would-be rivals such as Videotron and Wind;

- the mandated wholesale wireline decision that extends regulated wholesale access to the incumbent telecom and cable companies’ fibre-to-the-premise networks to help encourage competition in the retail broadband internet market while ensuring that rivals such as TekSavvy, Distributel, Primus and others can still compete as technology shifts from copper and coaxial-based networks to fibre-based facilities – all of which the incumbent telecoms and cable companies have fought tooth-and-nail, and which Bell has appealed to the Liberal Cabinet to overturn.

Several fundamental principles underpin these decisions.

A key point is the CRTC’s recognition that the “incumbent carriers continu[e] to dominate the retail Internet access services market” (CRTC, 2015-326, para 125). The wholesale mobile wireless decision arrives at the same conclusion (CRTC, 2015-177, paras 35, 72-74, 86-88). Moreover, there is “limited rivalrous behaviour” between the incumbents (CRTC, 2015-326, para 123). Lastly, whatever “competition that does exist today is largely, if not entirely, a result of regulatory intervention”, states the Commission (CRTC, 2015-326, para 123).

The upshot of this recent turn of events is two-fold: first, questions of market concentration and market power are not just conjecture but legal findings of fact. Second, in the face of such realities, the regulator has stiffened its spine and acted in a manner that marks a clear break from the “regulatory hesitation” that has defined so much of the regulatory culture in Canada in the past (Berkman, 2010, p. 163).

Whether this will continue to be the case is a crucial issue. However, history and international experience teaches that in the face of intransigent opposition from incumbents, only governments and regulators with a stiff spine and strong political will succeed in fostering more competition and improved developments in the communications and media fields (see, for example, Noam, 2013; Mazzucato, 2014; OECD, 2013, p. 23; Ofcom, 2012, pp. 67-68; Ofcom, 2012; Stucke & Grunes, 2012; Stucke & Grunes, 2016; US, DoJ, 2011; Berkman, 2010, pp. 162-168).

The Historical Record and Renewed Interest in Media Concentration in the 21st Century

While this regulatory turnaround is new, a keen interest in media concentration is not. As a matter of fact, there has long been a keen interest in the subject in Canada and the world over since the late-19th and early-20th centuries, even if it such interest ebbs and wanes over time.

In 1910, for example, early concerns with vertical integration were registered when the Board of Railway Commissioners (BRC) – the distant cousin of today’s CRTC — broke up a three-way alliance between the countries’ two biggest telegraph companies — the Canadian Pacific Telegraph Company and the Great Northwestern Telegraph Co. (the latter a division of the New York-based goliath, Western Union) – and the American-based Associated Press news wire service. Why?

It did this for much the same reasons that the CRTC chose to do as it did in the Mobile TV decision discussed a moment ago. That is, because carriers should not be editors who use their control over the wires (or spectrum) to decide who gets to speak to whom on what terms.

In this historical case, and in the face of much corporate bluster, the regulator was emphatic that while allowing the dominant telegraph companies to give away the AP news service for free to the leading newspaper in one city after another across Canada might be a good way for the companies to attract subscribers to their vastly more lucrative telegraph business it would effectively “put out of business every news-gathering agency that dared to enter the field of competition with them” (1910, p. 275).

In a conscious effort to use telecommunications (railway) regulation to foster competing news agencies and newspapers, Canada’s first regulator, the BRC, forced Western Union and CP Telegraphs to unbundle the AP news wire service from their telegraph service. It was a huge victory for the Winnipeg-based Western Associated Press that pressed the case, and other ‘new entrants’ into the newspaper business as well. It was also the decisive moment when the principle of common carriage born in Canada (Babe, 1990).

Throughout the 20th century similar questions arose and were dealt with as the situation demanded. One guiding rule of thumb of communications policy, however, was that of the “separations principle”, whereby telecoms carriers – usually two of them, e.g. telegraph vs telcos in the early 1880s, the TransCanada Telephone System (TCTS) and CNCP for three-quarters of the 20th century, the telcos vs cablecos ever since, and the telcos’ consortium Stentor versus Rogers/Cantel in the early days of mobile wireless from 1985 until the mid-1990s — competed to carry messages from all types of users, and for all types of purposes – business, personal, governmental and broadcasting – but were prevented by law from directly creating, owning or controlling the messages that flowed across the transmission paths they owned and controlled.

A general concern also hung in the air in government, business, broadcasting and reformist circles that those who made communications equipment, or operated transmission networks, should not operate broadcast stations, make movies or publish newspapers, books, software, etc. That this was so could be seen, for example, when the original equipment manufacturing consortia behind the British Broadcasting Company in the UK and the National Broadcasting Company / Radio Corporation of America in the US, respectively, were ousted from the field in the 1920s during the remaking of these entities into the stand-alone broadcasters that they eventually became. Nor should telephone companies such as AT&T play an active role in the film industry, as was the case when, after having wired movie theatres across the US and the Hollywood production studios for sound, circa 1927ff, AT&T took on a larger role by financing and vetting films during the 1930s (see Briggs, 1995; Barnouw, 1966; Danelian, 1939).

The consolidation of broadcasting under the CBC in the 1930s brought private broadcasters into the core of the Canadian ‘broadcasting system’ from the get-go. The creation of the CBC also wiped out important local, foreign and educational voices, and even a small theatrical radio club in Winnipeg who were taking live theatre from the state to the airwaves. In each case, it was the structure and organization of the communication / media system, and who owned what and in what proportions, that decided who got to talk to whom on what terms.

The separation of transmission and carriage from message creation and control was another principle that was worked out in a myriad of different ways. Aside from keeping the telegraph companies out of the news business, and telephone companies out of broadcasting and the movie business, most of the time such issues were considered tedious, boring, and tucked away in obscurity in parliamentary papers, legislation and corporate charters.

Bell’s charter, for instance, prohibited it from entering into ‘content and information publishing services’, from radio to cable TV and ‘electronic publishing’, until the early 1980s, when more and more exceptions to the general rule were adopted. The same was true for other telcos, private and public, across the country, even though Manitoba and Saskatchewan began to lay fibre rings in a few key provincial cities and offer modest cable TV services in the 1970s (Babe, 1990; Winseck, 1998).

Media concentration issues also came to a head in the 1970s, for example, and again at the beginning of the 1980s, when three inquiries were held: (1) the Special Senate Committee on Mass Media, The Uncertain Mirror (2 vols.)(Canada, 1970); (2) the Royal Commission on Corporate Concentration (1978); and (3) the Royal Commission on Newspapers (Canada, 1981). While these proceedings did not mount to much, they left a valuable historical and public record.

Things lay dormant for more than two decades before springing to life again after a wave of consolidation in the late-1990s and at the turn-of-the-21st century thrust concerns with media concentration back into the spotlight. Three inquiries between 2003 and 2008 were held as a result: (1) the Standing Committee on Canadian Heritage, Our Cultural Sovereignty (2003); (2) the Standing Senate Committee on Transport and Communications, Final Report on the Canadian News Media (2006); (3) the CRTC’s Diversity of Voices report in 2008.

Things have not let up since. Indeed, they have been on a high boil in recent years, with a non-stop series of reviews at the CRTC that will go a long way to shaping the emergent internet-centric media ecology for decades, including, for instance: (1) Bell’s take-over of Astral Media, (2) the regulated wholesale access decisions affecting both the mobile wireless and wireline telecoms markets, respectively, (3) the Mobile TV decision, (4) a series of cases now underway (or recently concluded) that test the extent to which vertically-integrated telecom-media giants such as Rogers, Bell and Videotron’s can leverage their control over networks to influence the content made available over those networks (see, for example, Videotron’s Music Unlimited case or the Rogers GamePlus and Hybrid Video-on-Demand decisions), and (5) the CRTC’s examination of “differential pricing practices,” that is, the use of content- or application-specific discriminatory pricing by mobile carriers and other ISPs.

Competitive Openings and Three Phases of Telecom, Media and Internet Consolidation

All of this is taking place, as I noted in the last report, within an ever more internet- and mobile-centric media economy that has grown immensely from $19.4 billion in 1984 to $77.8 billion last year.

The early years of that period (the decade between 1984 and 1996), was characterized by the emergence of new players across the media landscape and the growth of broadcast as well as pay and subscription television channels. In terms of ownership, existing players and a few newcomers, such as Allarcom and Netstar, cultivated the field.

During this period, television and radio broadcasters were often owned by companies whose interests lay in other, unallied areas, such as real estate, as with the BC TV and radio group Okanagan Skeena, or Molson’s Brewery, one of the founders of Netstar early in that entity’s history. These companies share of the market grew steadily until they were taken over by the larger players of their time, however, the generation direction of events was towards more players and, thus, toward more diversity in television ownership.

When consolidation did take place in the 1980s and 1990s it was mostly among individual players in single media markets. Conrad Black’s take-over of Southam newspapers in 1996 symbolized the times as did the amalgamation of local and regional television ownership groups at the end of the 1990s to create several national commercial television networks under common ownership: CTV, Global, TVA, CHUM, TQS.

While weighty in their own right, these amalgamations did not have a big impact across the media. The CBC remained prominent, but public television was being eclipsed by commercial television as the CBC’s share of all resources in the television ‘system’ slid from 44 percent in 1984 to less than half that amount today (19.6%).

Media conglomerates were not unknown (Maclean-Hunter was a good example), but they were not the norm. Bell was a diversified communications colossus, to be sure, but it was not in the media business proper, and was prevented by its charter and by law from being so.

In contrast to broadcasting any most other content media industries, concentration levels remained sky high in wired line telecoms, while new mobile wireless telecoms services were developed by two sets of competing firms: between 1983-1984, Rogers-Cantel was licensed by the Department of Communication to offer national wireless service, while 11 incumbent telephone companies (e.g. Bell Canada, Telus, MTS, Sastel) received licenses to provide competing services in their respective operating territories (Klass, 2015, pp. 58-61).

Gradual policy reforms characterized the 1980s and early-1990s, before a more concerted shift took place with the introduction of long distance competition in 1992, two new national competitors in wireless in 1995 (Clearnet and Microcell) and local telephone competition in 1997. The Chretien Liberals also gave the green light for the telephone and cable companies to compete in one another’s respective areas of dominance in 1996. Concentration rates fell across the board, except in cable television distribution.

In general, telecoms competition moved slowly from the ends of the network into services and then deeper into the network infrastructure, as it had done in one country after another around the world, aided and abetted by strong government interventions that used interconnection and network unbundling rules, access to spectrum, wholesale pricing regulation, and market liberalization to actively spur on competition. Competition gained traction in the 1990s as a result but the trend was thrown into reverse by the dot.com crash in late-2000.

Whereas gradual change defined the 1980s and early-1990s, things shifted abruptly by the mid-1990s and into the 21st century when three waves of consolidation swept across the media, telecom and internet industries. A few highlights help to illustrate the trends:

Wave 1: 1994 to 2004: Rogers’ acquisition of Maclean-Hunter (1994), but peaking from 1998 to 2001: (1) BCE acquires CTV and the Globe & Mail ($2.3b); (2) Quebecor takes over Videotron, TVA and the Sun newspaper chain ($ 7.4b) (1997-2000); (3) Canwest buys Global TV ($800m) and Hollinger newspapers papers, including National Post ($3.2b); (4) Telus acquires Clearnet ($6.6B, the largest acquisition in Canadian telecommunications history at the time) (2000).

Wave 2: 2004-2007: Rogers acquires Microcell ($1.4B) (2004). Bell Globemedia re-branded CTVglobemedia; BCE exits media business. CTVglobemedia acquires CHUM (Much Music, City TV channels and A-Channel). CRTC requires CTVglobemedia to sell City TV stations – acquired by Rogers (2007). Astral Media’s buys Standard Broadcasting. Quebecor acquires Osprey Media (mid-size newspaper chain)(2006). Canwest, with Goldman Sachs, buys Alliance Atlantis (2007) (Showcase, HGTV, BBC Canada and biggest film distributor in Canada).

Wave 3: 2010 – 2015: Canwest goes bankrupt (2009-2010), its newspapers acquired by Postmedia and TV assets by Shaw. BCE makes a comeback, buys CTV (2011) and bids for Astral Media in 2012, but fails to gain CRTC approval, before gaining the regulator’s blessing in 2013. Bell sells Teletoon (TELETOON Retro, TELETOON Retro, TELETOON / TELETOON and the Cartoon Network), Historia and Séries+ to Corus (Shaw), the Family Channel, Disney Jr. and Disney XD to DHX media, and MusiquePlus and MusiMax to V Media, as well as ten radio stations to Newcap (5), Pattison (3) and Corus (Shaw)(2) – as the Competition Bureau and CRTC required as a condition of approval of Bell’s take-over of Astral media in 2013; Telus acquires Public Mobile (2013); Rogers acquires Mobilicity ($465M)(2015); Postmedia acquires Quebecor’s English-language papers (e.g. including the six Sun dailies, 27 small dailies and 140 community weeklies) (2015) (also see Competition Bureau approval), and Shaw acquires Wind (early 2016).

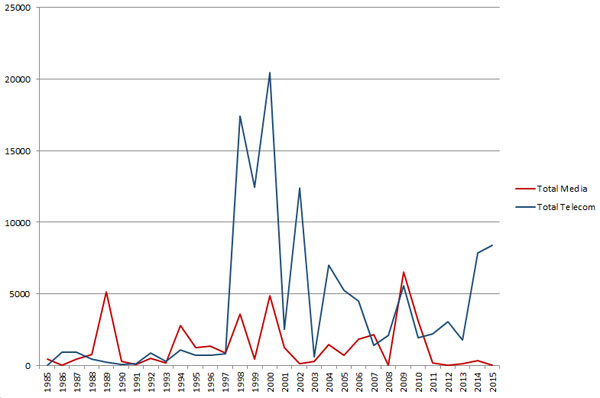

The massive wave of capital investment that drove consolidation across the telecom, media and Internet industries during these different phases is illustrated in Figure 1 below.

Figure 1: Mergers and Acquisitions in Telecoms & Media, 1985–2015 (Mill$)

Sources: Thomson Reuters. Dataset on file with author.[1]

Mergers and acquisitions rose between 1994-1996, spiked to unprecedented levels by 2000, and then collapsed when the bursting of the dot.com bubble brought things crashing to a halt. Consolidation regained steam between 2004 and 2007, then plunged with the onset of the Global Financial Crisis (2007ff), before rising significantly in four of the past six years. Again, trends in the network media economy swiveled on those evident in the economy at large.

Consolidation in the telecoms industry has been low for the past half-decade but a significant uptick has taken place since Telus bought Public Mobile in 2013, Bell acquired the stake in Bell Aliant that it did not already own at the end of 2014 and is now in the process of taking over MTS, pending regulatory approvals (See here for our report on the proposed merger), and Rogers acquired (and then dismantled) Mobilicity in 2015. On the media side, however, as Figure 1 illustrated, things have surged in recent years.

Shaw’s take-over of Global TV in 2010, with its suite of thirty specialty and pay TV channels and nine television stations, from Canwest (2010) as well as Bell’s re-purchase of CTV (2011) and take-over of Astral two year’s ago, respectively were responsible for the trend (includes joint ownership stake in Maple Leaf Sports and Entertainment) (see Pay & Specialty Channel List, sheet 2; BCE, Annual Report, p. 29). The latter set of deals transformed Bell into the biggest TV and radio broadcaster in the country, with a suite of thirty-one broadcast TV stations, forty-four specialty and pay TV channels, and 106 radio stations in fifty-four cities nationwide.

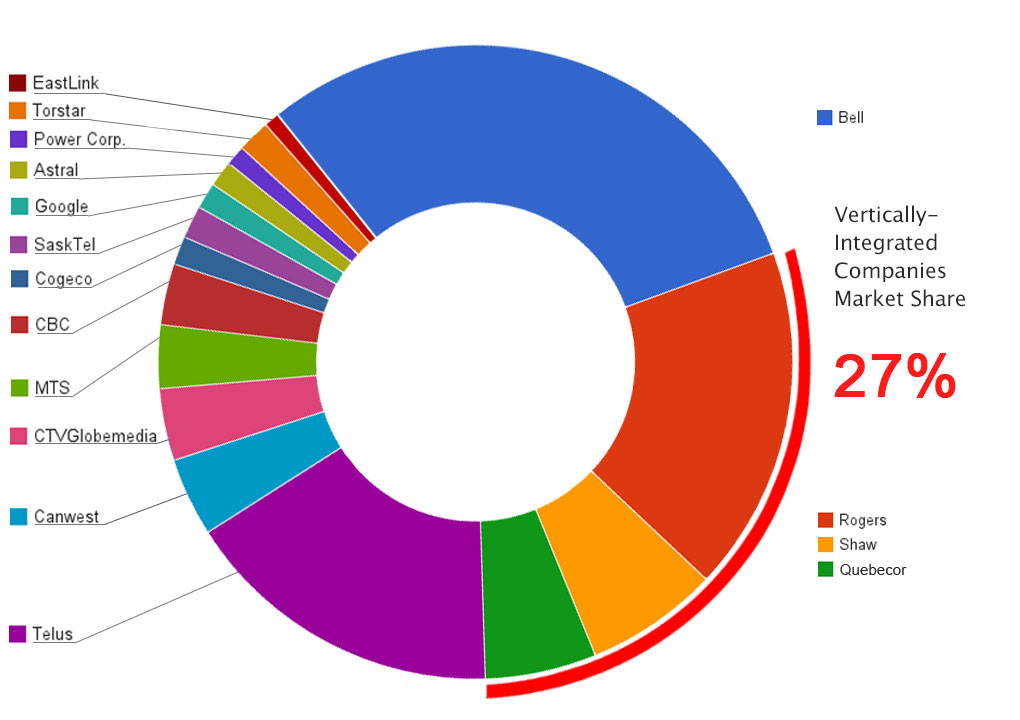

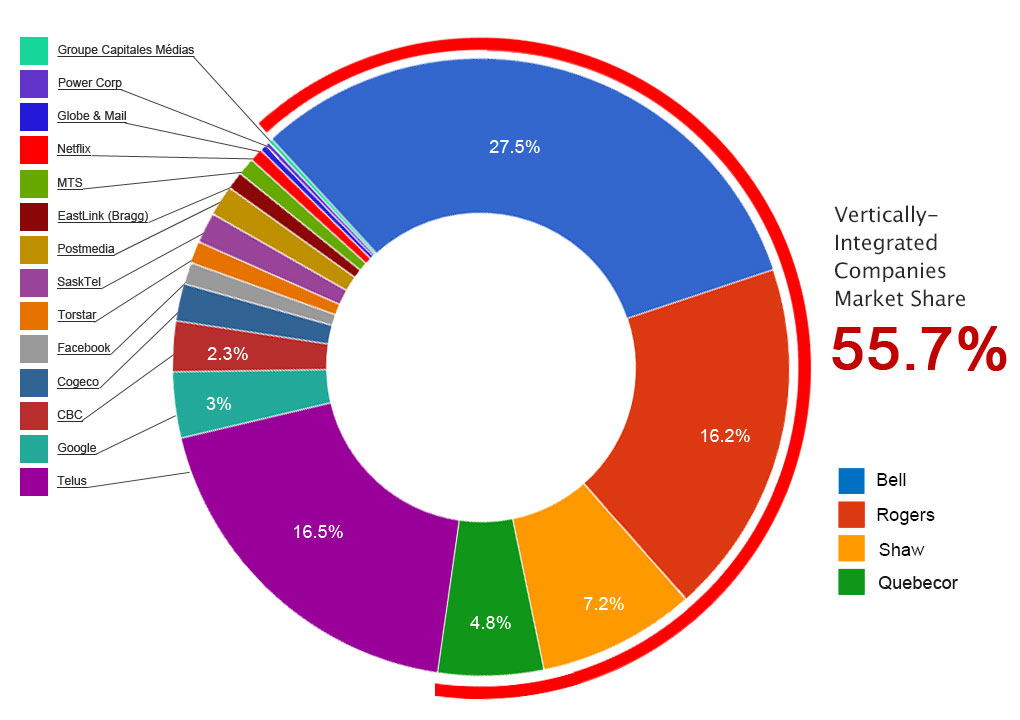

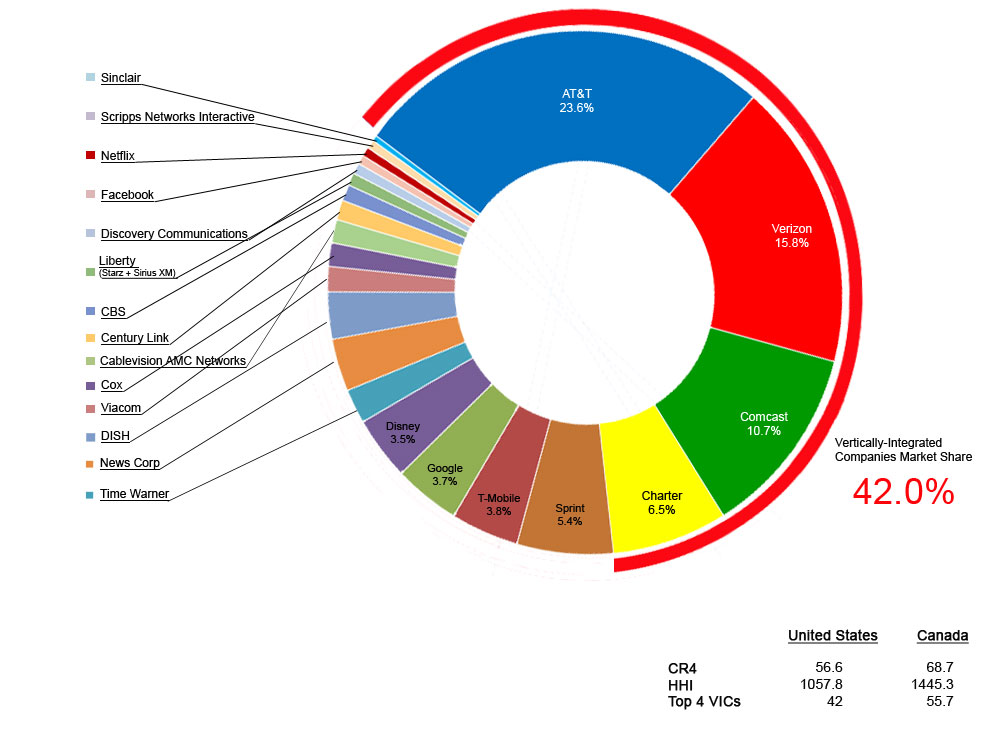

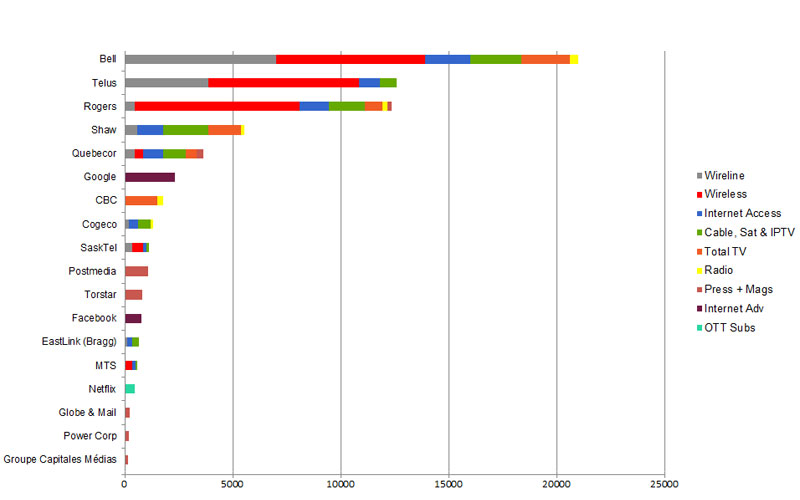

Consolidation in the TV industry has been the result. More importantly, though, consolidation has yielded a specific type of media company that now sits at the apex of the network media universe in Canada: i.e. the vertically-integrated telecoms, internet and media conglomerate. Vertical integration has soared and is now very high relative to the past and to conditions in the United States and internationally. Figures 2 and 3, below, illustrate the steep increase in vertical integration occurred between 2008 and 2015 (although having reached their high water mark two years earlier).

Figure 2: Vertical Integration and the Network Media Ecology, 2008

Sources: see the “Top 20 w Telecoms” sheet in the CMCRP Workbook.

Figure 3: Vertical Integration and the Network Media Ecology, 2015

Sources: see the “Top 20 w Telecoms” sheet in the CMCRP Workbook.

As Figures 2 and 3 illustrate, in the span of six years, the share of overall network media economy revenue held by vertically-integrated entities in Canada more than doubled. By 2015, four giant vertically-integrated TMI conglomerates accounted for 55.7% of all revenue across the whole of the network media economy: Bell (CTV), Rogers (CityTV), Shaw (Global) and QMI (TVA), as Figure 3 shows.

These developments are important for several reasons. First, they distinguish the past from the present. Centre stage is currently occupied by a handful of vertically-integrated telecoms, internet and media giants with a reach across the network media ecology, or five if we include Telus on account of its fast growing role in television distribution. Zero in on just telecoms and broadcasting, and the ‘big 5’ accounted for roughly two-thirds of all revenue in 2010. By 2015, that figure had soared to 84%.

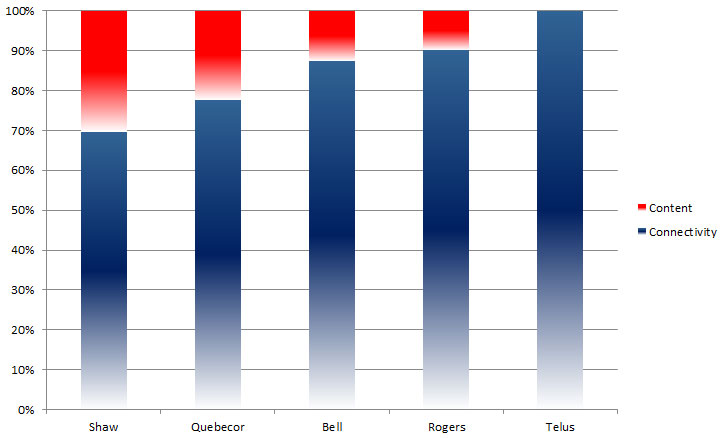

Second, these five companies’ control over communications infrastructure (content delivery) is the fulcrum of their business. Their stakes in content media, while extensive, are modest; Telus is not in the content business at all beyond buying rights for its Optik IPTV and mobile TV services. For Quebecor, Shaw, Bell and Rogers, 70-90% percent of their revenues flows from their control over bandwidth and connectivity rather than from content creation and exhibition. Figure 4 below illustrates the point.

Figure 4: Connectivity vs Content within Canada’s Vertically-Integrated Telecoms and Media Companies, 2015 (Ratio by Revenue)

Sources: see the “Top 20 w Telecoms” sheet in the CMCRP Workbook.

Content media have largely become but ornaments on the carriers’ organizational structures. They are strategically important but subordinate to the fact that their real purpose seems to be to drive the take-up of the companies’ wireless, broadband internet, and cable, satellite and IPTV services. The fact that nearly half (e.g. 40%) of the roster of Bell’s Mobile TV service, for example, is filled with channels it owns illustrates the point: CTV, CTV News Channel, CTV Two, Business News Network, Comedy Network, Comedy Time, MTV, NBA TV, NHL Centre Ice, E!, RDS, RDS2 and TSN, TSN2.

The CRTC has already determined in the Mobile TV case that Bell was using its control over the means of delivering television programming to confer an undue preference on its services at the expense of subscribers, rivals and independent sources of content available over the internet. Bell was quick to appeal that ruling to the Federal Court of Appeal, demonstrating the lengths to which the vertically integrated companies are willing to go to protect their ability to offer services as they please, although the appeal was rejected in mid-2016.

Other cases like Mobile TV, however, are emerging one after another in what appears to be a never ending game of regulatory whack-a-mole: see, for example, the complaint initiated by J. F. Mezei and the Public Interest Advocacy Centre against Videotron’s Music Unlimited, which has been rolled into a broad review of “differential pricing practices” now before the CRTC, or the Commission’s Hybrid Video-on-Demand decision,, or the Commission’s Hybrid Video-on-Demand decision, or Bell’s appeal of the wholesale vertical integration code, to name just a few. The thread connecting them all is the extent to which content is being tied to carriage in ways that raise crucial questions about the future of common carriage (“network neutrality”) and ‘the open internet’. These cases are the crux over which the “battle over the institutional ecology of the digital environment” is being waged, as Yochai Benkler once put it (pp. 383-460).

Vertical integration is not just high by historical standards in Canada, it is high relative to the United States and by international standards. Figure 5 below illustrates the point with respect to the United States.

Figure 5: Top Telecom-Internet and Media Companies in the US, 2016 (Market Share)

Sources: see the “Top US Telecom + Mediacos” sheet in the CMCRP Workbook.

Despite the obvious difference indicated in Figures 3 and 5, the contrast is even greater because the latter figure overstates the extent of the trend in the US by counting AT&T and Charter as vertically-integrated companies when in fact, the extent of their ownership of TV content services are negligible. This is true even after taking account of the fact that AT&T became the biggest BDU in the US last year after acquiring DirecTV. Other than a handful of regional sports networks, AT&T’s ownership in TV services and content is tiny. Charter’s just approved take-over of Time Warner Cable and Bright House does not change this fact. Ditto for Verizon, whose TV service holdings are miniscule. If we took AT&T out of the picture for this reasons and substituted Cox, the next biggest vertically integrated firm, the top four such firms in the US would account for 20% of all revenue – roughly a third the rate in Canada.

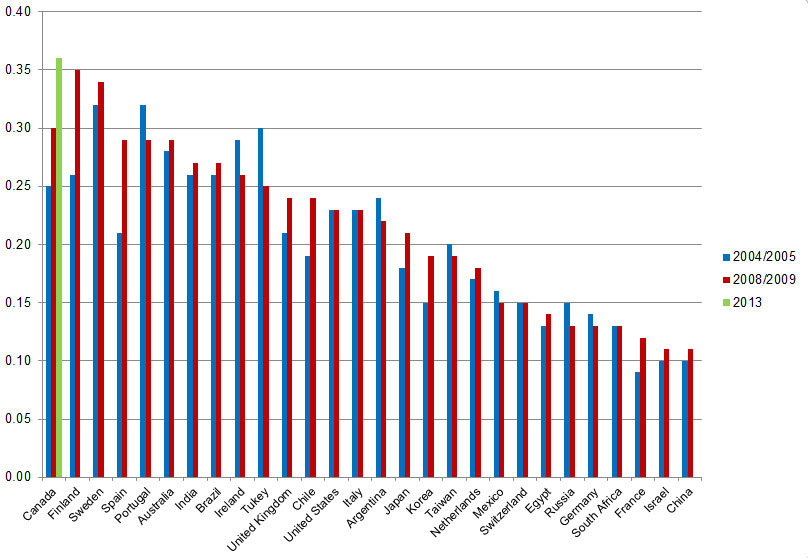

Figure 6 below uses the most recent data available for the twenty-eight countries covered by the International Media Concentration Research Project (2009) and for Canada for the years covered by that project and 2013 in order to account for Shaw’s acquisition of Global TV in 2010 as well as Bell’s acquisition of CTV and Astral Media in 2011 and 2013, respectively. It does so to illuminate the extent of vertical integration in Canada relative to international standards.

Figure 6: Vertical Integration and Cross-Media Ownership — Canada in a Global Context, 2004 – 2013

Sources: see the “CrossOwnership Canada vs World” sheet in the CMCRP Workbook and International Media Concentration Research Project.

Figure 5 reveals several interesting points. For one, it shows that Canada has long been closer to the high end of the scale when it comes to vertical integration and cross media ownership than to the low end. It ranked 19th out of 28 in 2004. By 2009, however, it had moved much closer to the top of the scale, with the third highest levels of vertical integration, after Finland and Sweden. In 2013, and after Shaw and BCE acquired Global TV, CTV and Astral Media, respectively, Canada had the highest levels of vertical integration and cross-media ownership out of the 28 countries studied.

While it is possible that similar processes took place in other countries after 2009, I am unaware of similar processes of such magnitude anywhere else. There has been a significant increase in vertical integration in the United States on account of Comcast’s acquisition of NBCUniversal in 2011, and last year’s acquisition of DirecTV by AT&T. that number will grow higher yet should AT&T’s proposed take-over of Time Warner be approved, but even after these transactions are accounted for, conditions in the US fall well short of what they are in Canada. Moreover, in most countries, the trend over the time period examined was in the opposite direction.

Indeed, as scholars from across the political spectrum have chronicled, while popular within the industry and amongst the mergers and acquisition crowd in the late-1990s, the tide toward vertical integration has turned since the early-2000s. Since then, media conglomerates have been dismantled or failed outright (e.g. AOL Time Warner, AT&T, Vivendi, Adelphia, CBS-Viacom, News Corp, etc). Cast in this longer and broader context, Comcast’s acquisition of NBCUniversal in 2011 and AT&T’s take-over of DirecTV in 2015 in the US are exceptions to the general rule (Picard, 2011; Jin, 2013; Skorup & Thierer, 2012; Thierer & Eskelen, 2008; Waterman & Choi, 2010).

The main trend, as Dal Yong Jin observes, since the mid-2000s has been toward vertical dis-integration and de-convergence.

The following sections double back to look at developments over time sector-by-sector, and within the three main categories we use to group each of the sectors covered by the CMCR project:

- platform media (wireline & wireless, ISPs and cable, satellite, IPTV);

- ‘content’ (newspapers, tv, magazines and radio);

- ‘online media’ (search, social media, online news sources, desktop and mobile browsers as well as desktop and smart phone operating systems).

At the end, I combine these again one last time to complete the analysis and gain a bird’s eye view of the network media industries as whole.

Platform Media

All sectors of the platform media industries are highly concentrated or at the high-end of the moderately concentrated scale, although Internet Access continues to be a partial exception. This has long been the case, although with important exceptions, past and present.

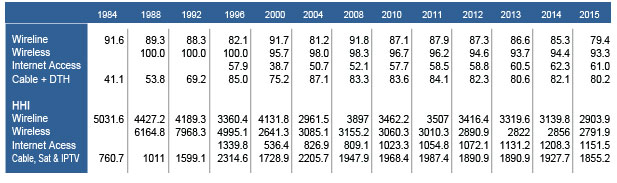

Table 1: CR and HHI Scores for the Network Infrastructure Industries, 1984 – 2015

Sources: see the “CR & HHI” sheet in the CMCRP Workbook + individual sheets for each sector.

CR4 and HHI measures for wireline telecoms scores fell in the late-1990s as competition gained traction, sped along by the introduction of long distance competition in 1992 and local telephone competition five years after that. Concentration in this sector reached its lowest levels ever between 2000 and 2004 as a result before the effects of the dot.com bubble collapse wiped out many of the new rivals with it (CRTC, 2002, p. 21).

Competition waned thereafter until 2008, but has risen since. Concentration levels fell significantly last year – indeed to their lowest level in the period covered by this report — on account of MTS’s sale of Allstream to the US backbone network operator, Zayo. That said, however, it still remains that the level of concentration in the wireline market remains very high by both the CR4 and HHI measures.

Mobile Wireless

In recent years, a number of studies have argued “that there is not a competition problem in mobile wireless services in Canada” (see here, here, here).[1] They also claim that, relative to international standards, concentration levels in mobile wireless services in Canada are at the low end of the range, and have fallen in recent years. The Canadian market is actually competitive and becoming more so, they claim.

In 2008, the Conservative government began to use spectrum policy and a series of new rules to more aggressively encourage new entrants to enter the market. Following the 2008 auction of “advanced wireless services” (AWS) spectrum, in which Industry Canada reserved spectrum exclusively for new firms, four “new entrants” joined the field: Wind, Videotron (Quebecor), Public Mobile and Mobilicity. Eastlink, a subsidiary of diversified conglomerate Bragg, won spectrum in the 2008 auction, technically making it a fifth “new entrant,” but for reasons unknown it waited until 2013 to launch service in its home territories in the Maritimes.

As a result of these efforts, levels of concentration in the mobile wireless section have come down, although they still remain firmly within the highly concentrated territory. The top three mobile network operators – e.g. Rogers, Telus and Bell – had a market share of 91% in 2015, down appreciabley from 96% when the previous government began its crusade to introduce a fourth wireless competitor in all areas of the country. Indeed, at least two of the new entrant mobile network operators have carved out a measure of success for themselves during this period as pro-competitive policy measures put into place by the previous government gained traction: Wind, and Vidéotron.

In what follows, we present an analysis of recent developments in the mobile wireless market, to better understand these high level trends.

The initial years were rocky for most of the new entrants. A challenge to Wind’s ownership was mounted by the CRTC in 2008/9 upon petition by Shaw and Telus; the Commission determined that Wind did not meet the foreign ownership criteria, creating uncertainty for the company’s future (Klass, 2015, pp. 74-76). The CRTC’s decision was overturned by the Conservative Cabinet in 2009, with the net effect being a major delay for the young wireless competitor. While this decision was also challenged, the issue became moot with a change to the legislated foreign ownership restrictions in 2012, which amounted to another prong in the Conservatives’ campaign to increase the competitiveness of telecommunications markets across the land. By the end of 2015, Wind had around 940,000 subscribers, a figure which was revealed when Shaw announced plans to acquire the “new entrant” provider. The transaction was completed in the first quarter of 2016, a development which marks a qualitative shift in the wireless market with what we believe are some very important implications.

Other new entrants have not fared well. Public Mobile failed in 2013, and was acquired by Telus. Similarly, Mobilicity was acquired by Rogers in 2015 following nearly two years spent under creditor protection, and Rogers is presently in the early stages of phasing out the brand, moving its subscribers over to its Chatr flanker brand.

Videotron, by contrast, appears to have fared quite well; by year end 2015, it had approximately 768,000 mobile subscribers in its operating territory of Québec and the National Capital Region. It has also struck network sharing agreements with Rogers in Québec, and in 2014 it purchased licenses for the desirable 700MHz spectrum in BC, Alberta, and Ontario, fuelling speculation that the company was preparing for a national expansion. Although Videotron has since announced that it has no such plans, its market share within Québec continues to rise, suggesting that it has found a viable space in the wireless business.

By the end of 2015, the combined national marketshare of the remaining new entrants had crept upward to just under 4%, compared to 3.1% a year earlier. Include MTS and SaskTel in the group and, combined, the new entrants and smaller regional incumbents accounted for nearly 8% of wireless revenues according to both the CRTC and the CMCR Project’s data (see “Wireless” sheet in the CMCRP Workbook and CRTC, 2016 CMR, Figures 5.5.6).

While the data reflect the success of Wind and Vidéotron, one detail that must not be missed is the fact that both (after Shaw’s acquisition of Wind) are now part of large communications conglomerates, so the extent to which they can truly be considered “new entrants” is debatable. Zoom out from a single focus on the wireless market, and we see that all wireless carriers are now part of diagonally integrated communications companies. Diagonal integration refers to a situation in which firms operate across distinct spheres of related markets (i.e. wireline and wireless broadband). This has important implications for understanding how firms offer services; for instance, as we have documented elsewhere, stand-alone mobile providers tend to offer more generous data buckets than mobile providers that are connected to wireline network operators. In short, expectations of disruptive behaviour from Wind and Vidéotron should be tempered in consideration of the fact that they both now operate as part of larger firms with often competing interests across the network media economy.

While the incumbents’ market share dropped appreciably between 2008 and 2013, it has remained virtually unchanged in the last two years. Rogers (32.4%), Telus (29.6%) and Bell (29.1%) accounted for 91.2% of the market by revenue at the end of 2015, or 90% when measured by the number of subscribers (see the “Wireless” sheet in the CMCRP Workbook and CRTC, 2016 CMR, Figures 5.5.5 & 5.5.6). The HHI score for mobile wireless in 2015 reflected the small gains made by smaller players, dropping to 2792 from 2856 in the previous year, a slight improvement, to be sure, but still far above the 2500 threshold that marks a highly concentrated market (see “Wireless” sheet in the CMCRP Workbook).

Moreover, national measures of concentration understate conditions in specific provinces, regions and cities, while overstating conditions in others. The least concentrated market in Canada is in Quebec, where Bell (31.9% share of revenues), Rogers, (28.8%), Telus (28.8%) face challenge not only between themselves but from Videotron as well. Videotron’s share of the Quebec market grew to 10.5% of revenues last year according to the CMCRP’s data, and 13% of subscribers according to the CRTC. Compared to Ontario, Alberta, and BC, the competitive scene in Quebec appears to have resulted in price relief for certain service tiers — between 15 and 30% for high-usage plans, according to providers’ online sites — although it is worth noting that entry-level tiers across the provinces just mentioned remain similarly priced. Eastlink launched its own mobile wireless service in the Maritime Provinces in 2013, and expanded to a handful of towns and cities in Northern Ontario during summer 2016, but it is still too early to see the results — an outcome made all the more difficult by the company’s tight-fisted approach to the public release of information.

In Quebec, the top two wireless companies had a combined subscriber market share of 59% — the lowest in the country by a large margin. The figures were in the 77-79% range in Alberta, Ontario and British Columbia in contrast, and much higher yet in Saskatchewan (81%), New Brunswick (83%), Manitoba (85%), Nova Scotia (87%), PEI (88%) and finally Newfoundland, Labrador and the Far North (99%) (CRTC, 2016). These figures, however, do not reflect the impact of Wind, which for unknown reasons has been excluded from the CRTC’s public data on province-level subscriber marketshare (CRTC CMR 2016, Table 5.5.8). In a nutshell, at the provincial level the data show that there tends to be one or two firms in a dominant position, with a third and/or fourth runner up trailing far behind. In other words, the geography of competition is limited.

That being said, communications markets do not always neatly conform to economic metrics. An example of this can be found by examining the mobile wireless markets in Manitoba and Saskatchewan. Each of those provinces’ wireless markets are dominated by the incumbent local exchange carriers (ILECs), MTS and Sasktel, who controlled 49% and 66% of total subscribers in their respective territories at the end of 2015. Although Sasktel and MTS are the two most dominant wireless providers by provincial market share, the competitive situation in the prairies evinces lower prices and a greater degree of choice amongst service offerings than found elsewhere in Canada, not just from the ILECs but from the competing national carriers as well.

For instance, both Sasktel and MTS offer mobile plans that include unlimited voice calling and unlimited mobile broadband usage on their province-wide networks, whereas ‘unlimited data’ is not to be found elsewhere in Canada, save within Wind Mobile’s footprint, which is largely limited to urban areas and still does not feature LTE speeds. Additionally, the national carriers have responded by offering prairie customers plans that feature much larger data buckets than those available at similar price points in other provinces (i.e. deep discounts), as Peter Nowak recently observed. Although CR4 scores are broadly similar across provinces, and HHI scores all fall within the “highly concentrated” range, competitive dynamics nevertheless differ from place to place, and understanding the facts behind the figures often benefits from this kind of analysis.

These difference may be coming to an end, however, as Bell announced its intentions in May 2016 to take over MTS, a move which would likely result in reduced competition not just in Manitoba, but potentially in Saskatchewan as well: should the deal be approved, Sasktel may be next on the chopping block, as some are speculating. The deal is not done yet, though, as at time of writing the merger (and the increase in concentration it represents) still awaits judgment from regulatory authorities at the Competition Bureau, ISED, and the CRTC.

The limits to competition are also illustrated by the fact that two of the new entrants have failed: Public Mobile and Mobilicity. Public Mobile was acquired by Telus in 2013 and shut-down the next year. Mobilicity was taken over by Rogers last year and then dismantled in a complex series of spectrum exchanges, much to Wind’s — and ultimately Shaw’s — benefit, which picked up additional spectrum at set-aside prices in Manitoba before selling it on to MTS.

The demise of Public Mobile and Mobilicity have largely redounded to the benefit of Wind and Videotron, which together saw their share of the ‘national mobile wireless market’ rise to 4%. Whatever gains have been had in the past few years are still far off the high-water mark of the late 1990s when two new rivals, Clearnet and Microcell, garnered 13% of the market between themselves before being taken over by Telus and Rogers in 2000 and 2004, respectively. Plus ça change, plus c’est la meme chose, as Daniel Paré has observed.

The CRTC was forthright in the 2015 Regulatory Framework for Wholesale Mobile Wireless Services decision in summing up what all this means for today:

- there has been very little change in retail market shares (either by revenue or by number of subscribers) in Canada in the past five years, despite entry into the market by several wireless carriers (para 35);

- the barriers to entry into the retail market are very high and the likelihood of new entry in the short to medium term is low (para 72);

- Rogers, Bell and Telus collectively possess market power in the national market for GSM-based wholesale roaming (para 74);

- Bell, Rogers and Telus “collectively possess market power in the national market for GSM-based wholesale MVNO access” (para 88); and

- “there is no rivalrous behaviour between the national wireless carriers in the provision of GSM-based wholesale MVNO access at a national level” (para 86).

The CRTC’s Wireless Framework decision highlights another interesting characteristic of the Canadian wireless market: the total lack of mobile virtual network operators, or MVNOs. As demonstrated by the CMCR Project’s 2014 report, Mobile Wireless in Canada: Recognizing the Problems and Approaching Solutions, MVNOs play an important role in wireless markets around the world, both from an economic and from a policy perspective. Regulators around the globe have taken steps to foster open access to wireless networks in order to spur competition from MVNOs.

In its decision, the CRTC determined that the national facilities-based wireless carriers had market power over third-party access to their networks, and had denied service to would-be competitors. While it took steps to encourage the entry of MVNOs, it stopped short of mandating access to the national carriers’ networks. In the absence of such a mandate, it is unlikely that third party service providers will emerge to provide market discipline similar to the way companies like Teksavvy, Distributel, and Primus have done under the mandated access regime that applies to Canada’s wired broadband networks.

Several challenges were mounted to the CRTC’s decision not to mandate MVNO access to the national carriers’ networks. In August 2015, the Canadian Network Operators’ Consortium, a trade group representing wholesale ISPs, filed an application requesting that the CRTC review and vary its decision, and require national carriers to allow independent MVNO access to their networks. The CRTC subsequently denied that application, although the issue has not been put to rest. In early 2015, Ice Wireless, a small mobile provider serving Northern areas of Canada, began to use its wholesale roaming agreement with Rogers to operate an MVNO called Sugar Mobile throughout Canada. The issue came to the CRTC when Rogers requested to terminate its agreement with Ice. While a decision is still pending on the matter, what is clear is that, as new entrants have failed or been consolidated as in the case of Wind, consumers and competitors continue to look toward MVNOs as a viable and attractive alternative to the concentrated status quo.

In sum, no matter how one looks at it, by city, region, province, or country, or by revenue, subscribers, or spectrum held and used, mobile wireless services are highly concentrated. While the prevailing CR and HHI levels in Canada are not especially high by international standards, the more pressing point is that concentration levels in mobile wireless markets around the world are, with few exceptions, “astonishingly high” (Noam, 2013, p. 8).

Given this, the real question is what, if anything, will be done about this state of affairs? The CRTC’s recent actions have begun to address that question.

Internet Access

As the telecoms and Internet boom gathered steam in the late 1990s new players emerged and become significant competitors. Indeed, by 1996, the incumbent telephone and cable companies’ share of the internet access market was minimal while four relative newcomers accounted for over a third of the market: AOL (12.1%), Istar, (7.2%), Hook-Up (6.3%) and Internet Direct (6.2%). As a general observation, incumbents were slow to arrive and in the meantime new players stepped into the breach to develop internet access in Canada.

The early ‘competitive ISP era’ continued up to the turn-of-the-century but subsided thereafter on account of, first, the collapse of the dot.com bubble, when many of the early ISPs went out of business and/or were absorbed by larger players, and second, the switch-over from dial-up to high speed internet access. By 2000, the big four’s (Bell, Shaw, Rogers & Telus) share of the internet access market had grown to 39%, but this was still one of the most competitive sectors of the network media economy at the time.

The industry has steadily consolidated around the incumbent telephone and cable companies ever since. By 2004, the top four firms accounted for roughly half of all revenues. That figure rose steadily over the next decade, to the point where the top four firms have accounted for around 60% of the market. The number in 2015, was 61%. The top five companies – Bell, Rogers, Shaw, Telus and Videotron, in that order – accounted for 71% of all revenues in 2015, by our measure, or 73% of the retail internet access market, according to the CRTC’s figures (p. 246).

The HHI score for internet access more than doubled between 2000 and 2015, but it is still low relative to most other sectors covered by this report and for this measure’s standards for concentration. However, this also reflects the limits of this measure. A closer look shows, for example, that 89% of the residential retail internet access market is accounted for by the incumbent telcos and cable companies on the basis of revenue or 88% when measured by the number of subscribers (CRTC CMR, Tables 5.3.2 and 5.3.4).

Broaden the measure to include both the wholesale and retail internet access markets, and the incumbent telcos and cable companies accounted for just over four-fifths of the market by revenue: e.g. Bell (22.8%), Rogers (14.5%), Shaw (13.1%), Telus (10.5%), Videotron (10%), Cogeco (4.7%), Eastlink (2.3%), SaskTel (1.8%) and MTS (1.5%) (see “ISP” sheet in the CMCRP Workbook). The two biggest indy ISPs – TekSavvy (257,000 subscribers) and ExplorNet (250,000)[2] – account for 3.1% of revenues, in contrast.

In short, when assessed at the local level, rather than on the basis of national HHI scores, the telcos and cable companies’ dominance of local markets across Canada is brought into sharper relief. The upshot is that while the national HHI standard implies a highly competitive market, a closer inspection reveals quite the opposite, with local internet access markets in cities across the country highly concentrated, with exceptions in very densely populated urban areas where wholesalers provide access.

According to the CRTC, there are about 500 independent ISPs scattered across the country, and altogether they accounted for 11.3% of retail internet access revenues in 2015. While the indy ISP’s share of the retail internet access market has crawled upwards over the past five years (CRTC CMR, Tables 5.3.2 and 5.3.3), but concentration at the local level continues to be stubbornly high.

Such observations underpinned the CRTC’s decision in early 2015 that found that the indy ISPs will still need regulated wholesale access to the incumbents’ local Fibre-to-the-Premise networks if they are not to be left to wither on the vine as broadband internet access migrates from copper and coaxial cables to fibre-to-the-doorstep. The Commission’s decision did not mince words:

- “incumbent carriers continu[e] to dominate the retail Internet access services market” (para 125);

- “there is limited rivalrous behaviour to constrain upstream market power” (para 122);

- wireless Internet access is not an acceptable substitute for wireline facilities on the grounds of significant disparities in terms of price, speed, capacity and quality (para 126);

- whatever “competition that does exist today is . . . a result of regulatory intervention” (para 126).

This was much the same reasoning that underpinned the Commission’s wholesale mobile wireless decision earlier in the year. In both cases, having found that concentration was not a matter of conjecture but of fact, the regulator decided to act, in the case just discussed to help ensure that whatever minimal competition that does exist today is not washed away tomorrow by the transition to fibre-based internet access. While Bell petitioned that decision, it’s appeal was ultimately rejected by the Liberal Government in May 2016.

Cable, Satellite and IPTV

There is no doubt that competition between cable companies and the telcos has intensified. Prior to the advent of IPTV services in 2004, consolidation in the BDU market had been rising for two decades, with a brief interruption after satellite TV services were introduced in the late 1990s. After declining to a contemporary low in 2000, when the top four BDUs accounted for 75% of the market and the HHI was 1729, concentration levels began to soar. By 2004, the top four BDUs — Shaw, Rogers, Bell and Videotron — accounted for 87% of the market; by last year the number had fallen to 80%. Either way, both figures are well over the 65% market share held by four players that the Competition Bureau uses as part of its merger assessment guidelines.[3]

The development of IPTV services has put the brakes on the upward drift of concentration visible a decade ago. At the same time, however, this is a change in degree, not in kind.

While many claim that widespread cord cutting is hurting the cable television industry, almost all of the losses to cable and direct-to-home satellite TV providers have redounded to Telus, Sasktel, MTS and Bell’s IPTV services. Revenue for the sector continues to grow at a slow pace. Our previous report covers this issue in some detail. From the time when MTS and SaskTel began to roll out IPTV services in 2004, followed later by Telus and Bell in 2007/2008 and 2009/2010, respectively, the HHI score has dropped significantly. In 2004, the HHI was 2206, last year it was 1855 – a significant drop, to be sure, but still well within the moderately concentrated of the scale (see the “CableSatIPTV” sheet in the CMCRP Workbook).

As noted in the last report, by the end of 2015, 17% of Canadian households got their television service from the local telephone company: e.g. Telus, Sasktel, MTS or Bell. These companies’ Internet Protocol TV (IPTV) services grew swiftly to 2,401,416 subscribers with revenues of $1.73 billion last year. By the end of last year, the telcos garnered close to twenty percent of the TV distribution market by revenue and subscribers, a doubling of their market share in just three years. The quick pace of growth has intensified competition between the telephone and cable companies’ TV distribution services.

Like broadband internet access, the cable, satellite and IPTV industry is still largely a duopoly at the local level. The “big four” control four-fifths of the market between them: Bell (26.5%), Shaw (23.2%), Rogers (18.7%), and Quebecor (11.8%). Add the next five largest players – Telus (8.4%), Cogeco (6.3%), Eastlink (3.4%), SaskTel (1%) and MTS (1%) – and pretty much all of the market is accounted for.[4] Again, it is local and regional cable and telephone companies that dominate the sector, replicating the pattern of limited competition in yet another area of the platform media industries.

Thus, while there is no doubt that competition has grown stronger in the television delivery business, concentration levels in the ISP market have not changed and those in the mobile wireless market are still remarkably high. Moreover, concentration levels have risen sharply across the telecoms and broadcasting landscape, as indicated earlier, over the past half decade. Whereas the “big five” – Bell, Rogers, Telus, Shaw and Quebecor — accounted for two-thirds of all telecoms and broadcasting revenue in 2010 that figure has soared to 84% in 2015. In sum, competition is growing in television distribution, but it is taking place within the context of greater concentration across the platform media overall and across the vertically-integrated telecommunications and broadcasting sectors.

The Content Media Industries

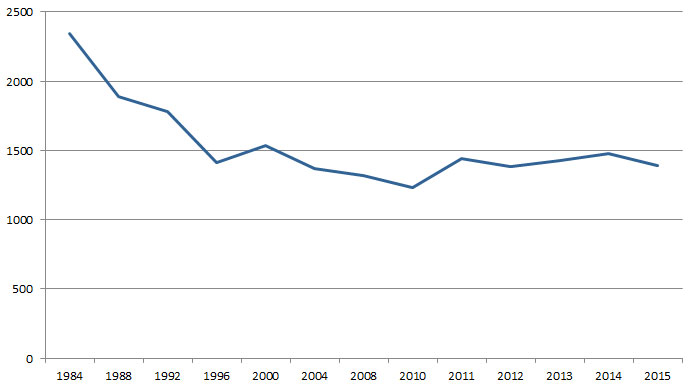

Television

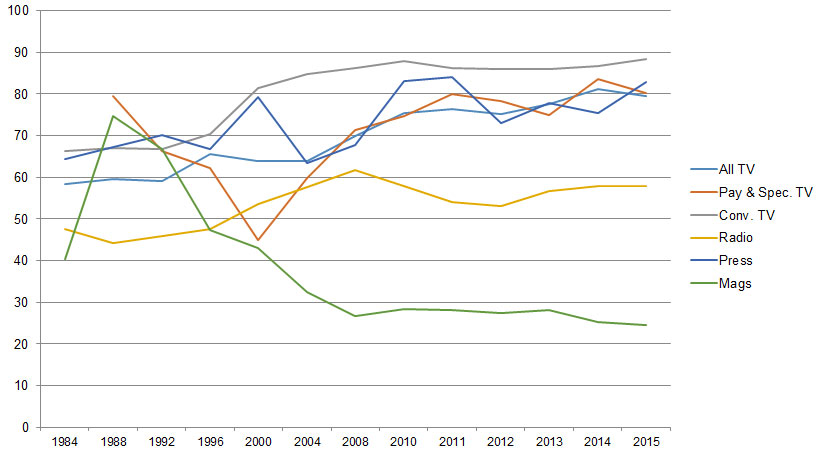

From the late 1980s until 1996, concentration in broadcast television fell sharply. The rise of specialty and pay TV channels magnified the trend. The television landscape became more diverse as a result. It was a major shift from an environment of relative scarcity to one of relative abundance.

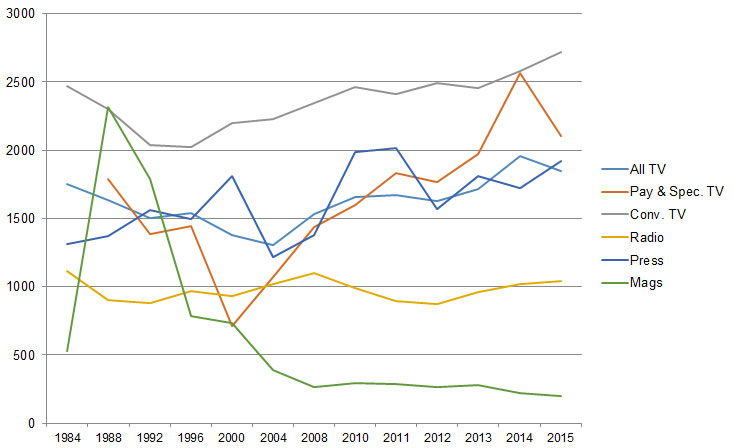

These trends in concentration levels reversed abruptly in the late-1990s, however, albeit with something of a lag before the specialty and pay TV market began to follow suit. After the turn-of-the-century concentration levels climbed steadily. The upswing since 2008 has been especially sharp. Figure 7, below, shows the trend for each of the content media industries in terms of CR scores; Figure 8 does the same in terms of the HHI.

Figure 7 CR Scores for the Content Media Industries, 1984-2015

Sources: see the “CR & HHI” as well as individual sector sheets in the CMCRP Workbook.

Figure 8: HHI Scores for the Content Media Industries, 1984-2015

Sources: see the “CR & HHI” as well as individual sector sheets in the CMCRP Workbook.

During the first half-decade of the 21st century, the “big four” accounted for 63% of the TV content business at a time when a handful of mid-range players such as Alliance Atlantis and CHUM had carved out a significant place for themselves in the TV marketplace (circa 2000-2006), respectively, before being absorbed into the maw of the industry’s largest players. By 2008, the “big four” accounted for 70% of revenue. In 2015, the four largest television groups – Bell, Shaw, CBC and Rogers — controlled 80% of all television revenues (including OTT services). Add Quebecor into the mix, and the number rises to 87% (see the “CR & HHI” sheet and specific sector sheets in the CMCRP Workbook as well as Television Channels by Ownership Groups).[1]

The recent upsurge in concentration levels in the television market is due mainly to four transactions.

The first is Shaw’s take-over of Canwest’s television holdings in 2010. The second was Bell’s buy-back of CTV a year later. Given CTV’s status as the largest television company in the country, the deal pushed concentration levels up greatly. The third significant moment occurred when Bell and Rogers’ each took a 37.5% stake in Maple Leaf Sports Entertainment (i.e. NBA TV, Leaf TV and Gol TV) in 2012 (with Toronto Construction magnate Lawrence Tanenbaum’s Kilmer Sports holding the rest) (CRTC, 2012; Bell 2013 Annual Report, p. 133).

The fourth step took place with Bell’s take over of Astral Media in 2013 after the CRTC reversed course from a year earlier when it curtly dismissed the deal. The increase in concentration was significant, even though Bell divested itself of eleven TV channels, as required by the Competition Bureau and the CRTC: Teletoon (TELETOON Retro/TÉLÉTOON Rétro, TELETOON / TÉLÉTOON, Cartoon Network), Historia and Séries+ to Corus (Shaw), the Family Channel, Disney Jr. and Disney XD to children’s television programmer, DHX media, and MusiquePlus and MusiMax to V Media.

The CTV, MLSE and Astral transactions marked Bell’s return to the field after having abandoned its earlier ill-fated convergence fling in the ownership of CTV and The Globe and Mail (circa 2000-2006)(a phase in its history that is curiously missing from the company’s annual reports). These transactions put Bell at the top of the league.