Growth and Concentration in the French-language Network Media Economy in Canada, 2000-2012

This post focuses on the development of and concentration trends in eight sectors of the network media economy in French-language regions of Canada from 2000 until 2012: i.e. wireline telecoms, mobile wireless services, internet access, broadcast tv, pay and specialty tv channels, total tv, radio and online advertising. It is a follow up to previous posts that looked at these matters across Canada as a whole (see here and here)(for a downloadable PDF version of this post please click here).

As with the previous posts, the data and methodology underpinning the analysis in this post can be found through the following links: French Media Economy, CR and HHI French Media, Media Industry Data, Sources and Explanatory Notes and the CMCR Project’s Methodology Primary. Additional resources for further analysis of the media in French-language regions of Canada can be found through the GRICIS research project at Université du Québec in Montreal and the Centre d’études sur les médias at Laval. Journalist Steve Faguy is also knowledgeable about the media industries in Quebec.

So what did we find?

The Growth of the French-Language Network Media Economy, 2000-2012.

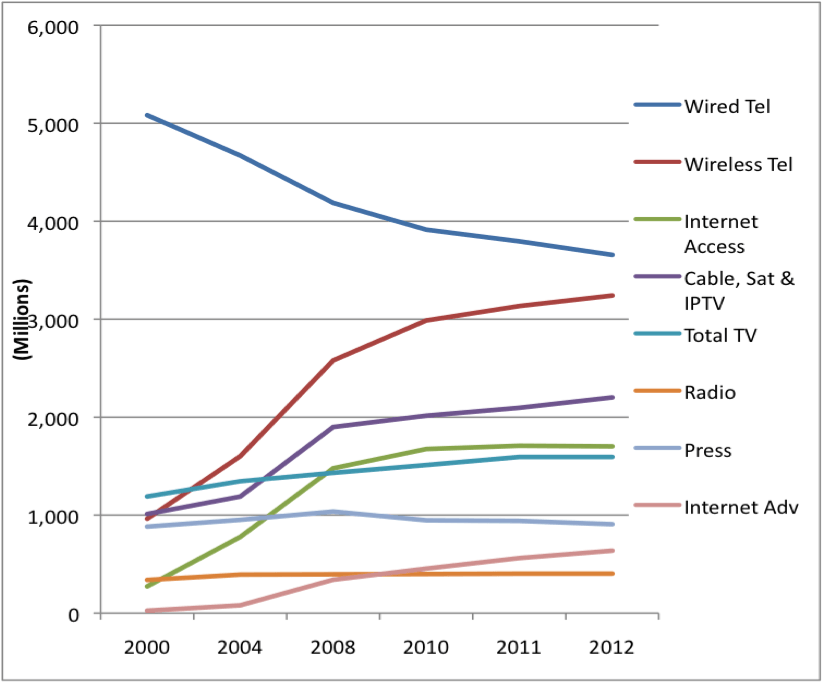

The media economy in French-language Canada has expanded greatly since 2000. Revenues rose from $9.8 billion to $14.5 billion in the last dozen years and, indeed, the French-language media grew faster than in the rest of Canada. The relatively fast pace of growth, however, has slowed considerably since the “great financial crisis” of 2008, just as has been the case with the rest of Canada and indeed for much of the Anglo European world,

The faster rate of growth relative to the rest of Canada likely reflects the fact that, historically, the French-language media economy has been smaller than what its population size would dictate. While Quebec’s population accounts for about 23% of the national total, in 2012 it’s media economy accounted for just over a fifth of the total Canadian media economy (20.6%) – although that was up from 18% at the turn-of-the-century.

Figure 1 below shows the trends.

Figure 1: The Growth of the French-Language Network Media Economy, 2000-2012

Sources: French Media Economy, Sources and Explanatory Notes.

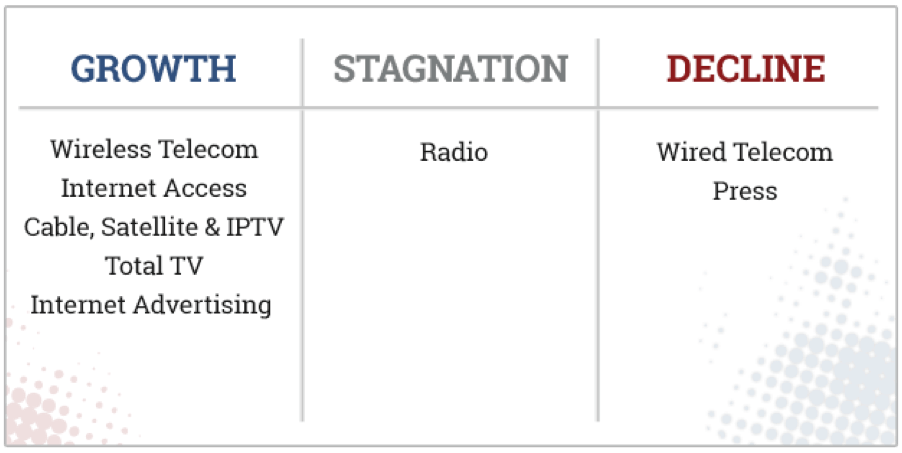

The fastest growing sectors of the French-language media economy,have been in internet advertising (2,442%), internet access (524%), mobile wireless services (237%), cable, satellite and IPTV (118%) and, less so, television (34%). This too is similar to patterns in the rest of Canada, and worldwide. By and large, it is the platform media industries and, less so, television that are driving the growth of the network media ecology, adding both to its size and structural complexity. The French-language media ecology is, thus, becoming more internet centric, mobile and personal.

At the opposite end of the spectrum, wireline telecom has fallen by more than a quarter. Newspapers revenues has also declined from an estimated $1,036 million at what seems to have been its peak in 2008, before falling to $907 billion last year – a drop of 12%.

One important thing distinguishes French-language dailies form the rest of the country: paywalls. Unlike the English-language press where twenty-four dailies accounting for two-thirds of circulation have put up paywalls in a bid to stem the industry’s outgoing economic tide, only two dailies out of ten in Quebec representing just under half of average daily circulation – Quebecor’s Le Journal de Montréal and Le Journal de Québec – have done so.

Power Corporation’s La Presse has resisted the temptation. This difference in the extent to which English- and French-language dailies have embraced paywalls likely reflects the fact that Radio Canada/CBC looms larger in Quebec than elsewhere in Canada, and perhaps cultural considerations as well.

Radio has grown only modestly since 2000. In fact, since 2008, revenue has stagnated. This is largely because of budget cuts and restraint in government funding of the CBC and flat advertising spend. The latter, to repeat a point already made home is a reflection of continued economic uncertainty in the wake of financial crisis, while the latter reflects political and policy responses to pressure from, amongst others, Quebecor’s Sun newspaper and some journalists in the English-language press to trim the CBC’s ambitions to bootstrap a public service view of digital media into the increasingly internet- and mobile-centric media universe on the grounds that such actions unfairly compete with the commercial supply of news, views and entertainment.

One more thing that stands out from Figure 1 is the extent to which the growth of several media flattens or goes into decline after the onset of the “great financial crisis” in 2008. Indeed, several sectors see a dogleg in growth at this time: cable, satellite and IPTV as well as internet access, notably. Even fast growing mobile wireless services slowed, while newspaper revenues dropped.

Figure 2 below gives a snapshot of these conditions based on trends since 2000.

Figure 2: Growth, Stagnation and Decline in the French-language Media Economy, 2000-2012.

Leading Telecoms, Media and Internet Companies in Quebec

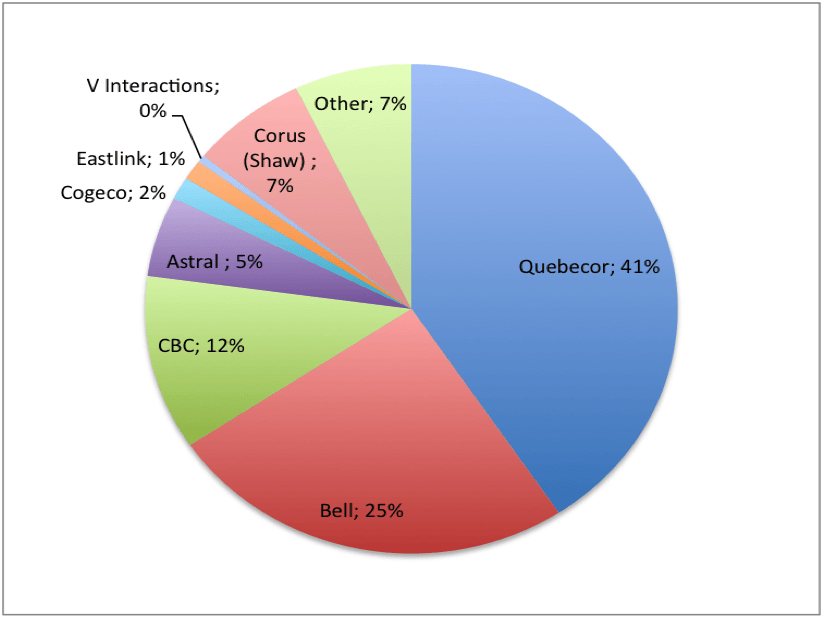

Every study of the Canadian media industries highlights the colossal role that Quebecor plays in French-language media, and rightly so. The company’s reach across the telecoms, television, newspaper, magazine, book and music retailing landscape is enormous. With over 80% of the sprawling media conglomerate’s $4 billion in revenues — $3.3 billion — coming from Quebec in 2012,[i] the company single-handedly accounts for over one-fifth of all French-language network media economy revenue.

While Quebecor no doubt cuts an imposing figure within French-language media, it is not the largest media conglomerate in this respect; Bell is — by a large margin. Figure 3 illustrates the point and shows the top 14 companies and their revenues from the eight sectors canvassed in this post. Figure 4 immediately after that shows what conditions would have looked like if the CRTC had approved Bell Astral Version 1.0.

Figure 3: Leading Media, Internet and Telecoms Companies in Quebec, 2012 (millions$).

[visualizer id=”775″]

Figure 4: Leading Media, Internet and Telecoms Companies in Quebec, 2012 (millions$) — Post Bell Astral Version 1.0

[visualizer id=”778″]

Sources: Media Industry Data, French Media Economy, Sources and Explanatory Notes.

Several interesting points stand out from Figure 3. First, taking all their holdings into account in Quebec, Bell’s 2012 revenues of just over $5 billion outstripped Quebecor’s $3.3 billion by a large margin. In fact, BCE accounted for more than a third of all revenue in Quebec, which was roughly equal to the next three biggest players combined: Quebecor, Rogers and Telus.

If the CRTC had approved the 2012 version of Bell’s bid to take-over Astral, as Figure 4 illustrates, the gap would be larger yet. Under the first version of that failed transaction, BCE’s total share of the French network media economy would have been 37.2% versus 22.6% for Quebecor (the consequences of the Competition Bureau and CRTC’s approval of Bell’s revised bid to acquire Astral in early 2013 will be discussed in next year’s post when the effects based on 2013 data will be discernible).

As Figures 3 and 4 both show, Bell and Quebecor are in a league of their own. The two vertically-integrated giants tower over their peers, most of whom operate in only one or two sectors. Cogeco is a partial exception because it too is vertically integrated because of its stakes in high-speed internet access, basic phone service, cable tv and radio, but its revenue ($445 million) and market share (3.1%) across the ‘total network media economy’ are puny by the standards of Bell or Quebecor.

Joining Cogeco are another half-dozen or so second tier players: Rogers, Telus, the CBC, Power Corp, Astral and Google with French-language media revenues in $200-$950 million range. Telus and Rogers’ stakes in Quebec are mostly limited to mobile wireless services, although the size of the mobile wireless segment, and the fact that after internet advertising and internet access, it is the fastest growing sector, means that the two companies loom large in the province. Google is ranked ninth based on estimated revenues of $268.4 million from online advertising in 2012 and just under two percent share of the entire network media economy (versus $242.2 million in 2011).

The CBC still cuts a formidable presence in the province as well. Indeed, it is the largest player in TV and radio, with a 40% and one-third share of both media markets, respectively, compared to Quebecor with one-quarter of the French tv market and Astral’s 27% of the radio market in 2012. The CBC/Radio Canada’s major role is probably one reason, as mentioned earlier, why the French-language press has been more hesitant to introduce paywalls, as noted above; it is also why the CBC is so vilified by Quebecor and others in the English-language press.

Power Corps’ place as the seventh largest media enterprise in French-language markets gives a sense of the continued importance of the press within the overall mediascape and of the scale of its newspaper interests (i.e. La Presse, Le Nouvelliste, La Tribune, La Voix de l’Est, Le Soleil, Le Quotidien, Le Droit). Power Corp’s share of average daily circulation is equal to that of Quebecor’s two French-language dailies, Le Journal de Montréal and Le Journal de Québec: 47%. Independents pick up the remaining six percent of the circulation and revenues.

The French-language newspaper market, in short, is extremely concentrated, and more so than the national situation. Given the importance of newspapers amongst political and business elites, it is this dominance that no doubt draws a critical eye to both companies, and especially to Quebecor given it’s sprawling grasp across media, while Bell’s relative absence from ‘opinion influencing media’ seem to give it a freer hand in this regard.

Finally, a number of smaller players with less than one percent market share round out the ranks: Eastlink (.7% market share), V Interactions (.5%), Facebook (.2%) and Shaw (.2%). Together these four companies account for less than two percent market share.

Media, Internet and Telecom Concentration in the French-language Network Media Economy, 2000-2012

Beyond the individual companies and their ranking, the most notable point with respect to the French-language media is the extent to which just two entities — BCE and Quebecor – dominate the landscape. Together, they account for well over half of all revenues (57%) (BCE’s market share in 2012 was 34.7%; Quebecor’s 22.6%). Their combined weight goes a long way to explaining why concentration trends across the board are considerably higher for French-language media markets than in their national counterparts, except wireless. These points are important for several reasons.

For one, they show that the national measure we usually rely on can be insensitive to local/regional realities. To put this bluntly, we under-estimate concentration levels, not exaggerate them with our typical focus on national level analysis. The situation in French-language markets is probably a more accurate reflection of the whole. The bigger upshot of all this is that the case that media concentration in Canada is high and a problem is thus even stronger than we typically let on.

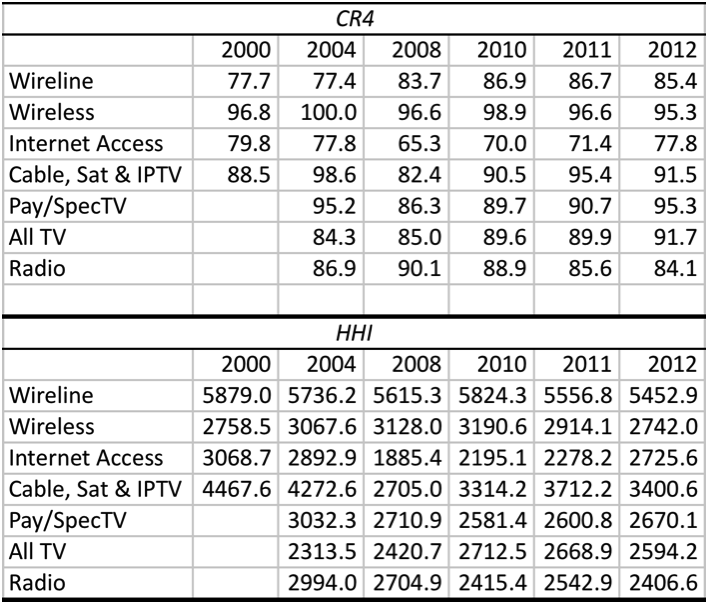

Table 1, below, depicts the trends over time on the basis of Concentration Ratios (CR4) and the Herfindhahl – Hirschman Index (HHI) (see methodology discussion in the last post and the CMCR project’s methodology primer).

Tables 1: CR and HHI Scores for the French-language Media Economy, 2000-2012

Sources: CMCR Project CR and HHI French Media.

Table 1 shows that every single sector of the media, telecom and internet examined here is very highly concentrated in Quebec, except for radio which slipped under the threshold for the designation in 2012.

The Platform Media Industries

One notable trend moving gradually in the opposite direction is the steady decline in the extremely high levels of concentration in mobile wireless services. One thing that stands out in this regard is that Quebecor has emerged as a significant rival to Bell (33% market share), Rogers (29%) and Telus (28%) since entering the market after acquiring spectrum in the last round of spectrum auctions in Canada in 2008.

Quebecor’s share of the market has grown to 5.3% (based on revenues) in the four years since it entered the market, effectively demonstrating the viability of the 4th player strategy. Other newcomers, notably Wind, have picked up about 4.7% market share, as well. As a result, Quebecor, Wind and other newcomers now account for 10% of the market, while the big three’s share has dropped to 90% since 2008. While the mobile wireless market is still highly concentrated by the CR4 (95.3%) and HHI (2742) measures, Quebec stands out as (1) the province with the highest levels of competition and (2) indicating the viability of a “4th mobile wireless carrier” strategy.

In contrast, a less unusual trend can be seen when we turn our attention to internet access. In this case, the levels of concentration are much higher in Quebec than they are across the country. Indeed, concentration levels for internet access have risen steadily and sharply since 2008, reaching an HHI of 2726 in 2012, a score that is firmly in the very concentrated zone versus one that was more in the moderately concentrated region just four years earlier. The CR4 in 2012 was also high at 78%.

In contrast, Canada-wide, the CR4 was 59% and the HHI at the low end of the scale at 1051. It is the former measure that is the more accurate, though, while the gap between them reflects our use of national measures despite the fact that access to the internet is defined by the choices available locally. Both measures are useful, nonetheless, and this why we look at things from multiple angles.

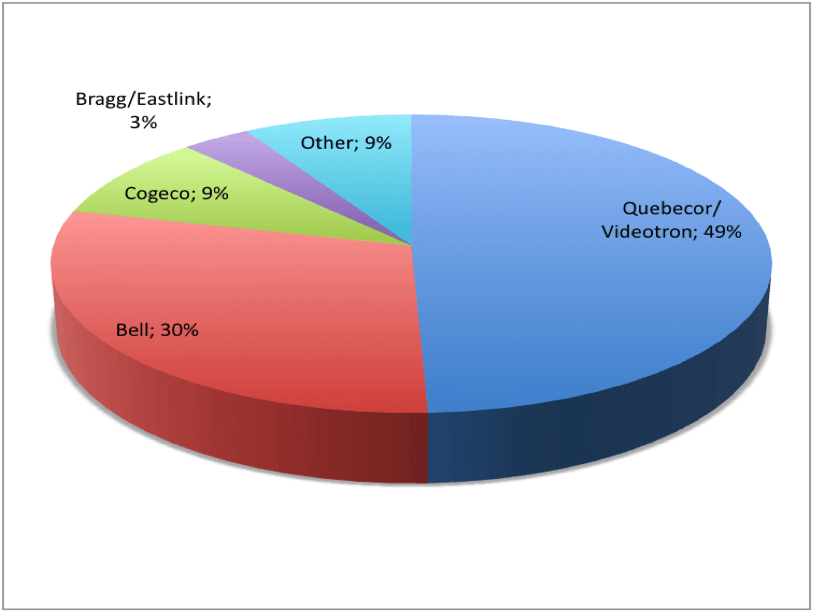

In terms of the broadcast distribution markets (BDUs), IPTV services have steadily grown to become more significant rivals to incumbent cable and DTH companies since 2010. The CR4 and HHI scores both fell slightly between 2011 and 2012, but are still at the extremely concentrated end of the scale with a CR4 of 91.5% and an HHI of 3400.

Concentration has hardly budged over the past few years. In 2012, Quebecor and BCE accounted for 49.3% and 29.5% market share, respectively, or just shy of four-fifths of the BDU market. The big two have clashed over the past twelve years, however, as BCE’s share of the market nearly tripled, rising from 10% to 30%, while Quebecor’s slid from 65% in 2000 to just under 50% in 2012.

A key reason why concentration remains sky high in Quebec is that BCE began rolling out IPTV services in 2010, half-a-decade later than in the prairie provinces, and did so in a way designed to protect its investments in DTH satellite TV. Cogeco and Eastlink remain distant rivals behind the big two, with 9% and 3.5% market share respectively. BDU markets in Quebec, like everywhere else in Canada are effectively a duopoly. Figure 5 illustrates the point.

Figure 5: Cable, DTH & IPTV French-Language Market Share, 2012

Sources: French Media Economy, Sources and Explanatory Notes.

The Content Media Industries

Casting the net a bit more broadly to bring television into view alongside the distribution side of this domain also illustrates the extent to which Quebecor and Bell, and their strategies of vertical integration, stand apart from the rest of the field by a very wide margin. As Figure 6 below illustrates, the “big two” account for about two-thirds of the total tv universe, including distribution platforms. The CR4 for this measure is just shy of 82%, while an HHI of 2377 puts it just under the threshold for highly concentrated markets.

Again, it is worthwhile to reiterate that such claims are based on 2012 data before consolidation increased yet further on account of Bell’s take-over of Astral Media. Figure 6 illustrates the state of affairs with respect to BDU and the total television market in Quebec as of 2012.

Figure 6: Vertically-Integrated BDUs and Total Television by French-Language Market Share, 2012

Sources: French Media Economy, Sources and Explanatory Notes.

French-language broadcast television consists of three main players: CBC/Radio Canada (60% market share), Quebecor/TVA (27.3%) and V Interactions (7.8%). Broadcast television is extremely concentrated with the top 3 players accounting for 95$% of revenues and a sky-high HHI of 4403. Bell has no interests in this segment, and did not acquire any either when taking over Astral.

Radio is not nearly as concentrated, but still sits at the high-end of the moderately concentrated spectrum with an HHI of 2407 and a CR3 of 84%. Once again, the biggest player on the radio landscape is the CBC/Radio Canada, with a third of all revenues. Astral was the top commercial radio broadcaster and 2nd after Radio Canada and ahead of Cogeco in 2012 with 27%. The “big 3” control 84.1% of radio, and the sector fell just under the threshold of highly concentrated in 2012 based on an HHI score 2407. The biggest change in recent years was the exit of Shaw (Corus) from French-language radio in 2011 after a radio station swap with Cogeco.

The trend for French language pay and specialty TV services followed a U-shaped pattern over the decade, with concentration declining between 2004 and 2010, but rising again after 2010. Despite the half-a-decade or so dip, this sector has always remained highly concentrated on both the CR4 and HHI measures, with the “big four” – Astral, BCE, Quebecor and the CBC – accounting for 95.3% of revenues in 2012, and an HHI score of 2670.

Bell was already the second largest player in specialty and pay tv services in 2012 with a 27.1% market share. It would have single-handedly held an extraordinary two-thirds (64.8%) of the market had its original bid for Astral Media — the biggest player in this sector — been given the green light by the CRTC in 2012. The CR4 would also have risen from 95.3% to 99.3%, and the HHI score soared to 4,715. While the outcomes from the 2013 Bell Astral transaction will be assessed in next year’s version of this post, the difference is a matter of slight degree, not in kind: the results are off-the–charts in terms of CR4 and HHI guidelines.

In 2012, the total French-language TV market was highly concentrated by either the CR4 (92%) or the HHI (2594). The biggest entity is still Radio Canada, with 40% market share, trailed by Quebecor (TVA)(24%), Astral (16%) and Bell (11%). Had Bell’s original proposal to acquire Astral been approved as planned without any divestitures, its market share would have risen sharply from 11.1% to 27.7% and the third largest player, Astral, would have disappeared.

Concluding Thoughts

Studying the media industries and their evolution over time is never easy, and it becomes more difficult the deeper one probes simply because so much data is not released to scholars or the public. However, based on what we do know and some reasonable estimates of revenues and market shares derived from that, we can arrive at a pretty detailed and reasonable portrait of the French-language network media economy.

And in this regard, several things stand out.

- the French-language media economy is very concentrated and much more so than the Canadian media economy as a whole.

- Bell is the largest player in French-language markets with over one-third of all revenues across a wide swathe of media, followed by Quebecor with just under a quarter of the market across an equally large span of media, telecom and internet markets. The two are in a league of their own.

- The market shares of BCE and Quebecor are significantly larger within Quebec than they are on the national stage (e.g. for Bell, its total share of the French-language market is 35%, while nationally it is 28%; for Quebecor, the gap is more pronounced, with 23% of all revenues in Quebec versus a modest 6% at the national level).

- Similar patterns are observable in terms of the structure of the network media economy as a whole, with an HHI of 1800 in the French-language media being 400 points higher than what it is at the national level.

- Two important exceptions to this general portrait need to be made. First, radio nominally falls into the moderately concentrated zone. Second, the steady uptick in competition in wireless bodes well for those who suggest that a fourth wireless competitor strategy might be just what is needed to help the ailing mobile wireless sector in Canada, at least if international measures are our guide (see here, here, here and here).

[i] For the sectors covered by the CMCR project and not including music and books.